illinois teacher pension databasewas caiaphas a levite

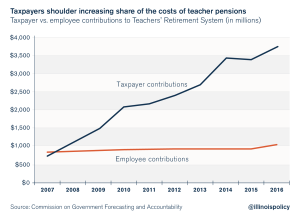

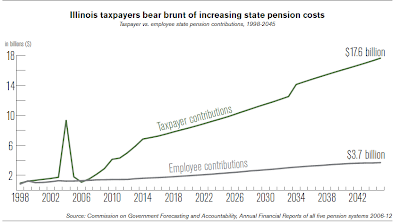

"'This is insanity,' said William Huley, president of Arlington the inflated pensions that result is spread to taxpayers statewide,  View it in your web browser. They should also contact their lawmakers, urging them to support a pension amendment in 2022 that will better protect their pensions. Search Illinois Public Employee Pension Data. But wait, there's more! WebWe just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicago and some downstate pension funds.

View it in your web browser. They should also contact their lawmakers, urging them to support a pension amendment in 2022 that will better protect their pensions. Search Illinois Public Employee Pension Data. But wait, there's more! WebWe just added 2020 data on pension payouts to individuals and updated the status of funding levels for Illinois, Cook County, Chicago and some downstate pension funds.  You can find us on any of our social pages or reach out directly. Of course, unions have a history of advocating for higher taxes to address the pension crisis. contact this location, Window Classics-Miami When the first of the month occurs on a weekend or holiday, your financial institution may not post your deposit to your account until the next business day.. The payroll deferrals, together with any earnings, accumulate tax-deferred until the employee terminates service, dies, or incurs unforeseeable financial hardship Tier 2: Members who join CTPF on or after January 1, 2011. 66 2/3% of the earned annuity of the unretired member; no age reduction. Contact Us. A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements. Chicago Office | Illinois Policy

for a district to grant astonishing pay raises in the last few years before User Guide. Theaverage Social Security benefitfor 2019 is $17,532 per year. Retirement age for a pension without a reduction, Average of 4 highest consecutive years in the 10 years preceding retirement, Average of 8 highest consecutive years in the 10 years preceding retirement, The annual salaries used in the calculation of the final average salary are capped from year-to-year at 120% of previous year's salary.*.

You can find us on any of our social pages or reach out directly. Of course, unions have a history of advocating for higher taxes to address the pension crisis. contact this location, Window Classics-Miami When the first of the month occurs on a weekend or holiday, your financial institution may not post your deposit to your account until the next business day.. The payroll deferrals, together with any earnings, accumulate tax-deferred until the employee terminates service, dies, or incurs unforeseeable financial hardship Tier 2: Members who join CTPF on or after January 1, 2011. 66 2/3% of the earned annuity of the unretired member; no age reduction. Contact Us. A member's benefits are suspended if the limit is exceeded and the member has not been approved to teach in a subject shortage area.The 140 days/700 hours limit is in effect through June 30, 2022.For a detailed example on how to calculate your days and hours worked, select this link., For the 2022-23 school year, the post-retirement limitations will revert to 120 days or 600 hours. On January 1, 2011, the Illinois legislature established two sets of pension eligibility requirements. Chicago Office | Illinois Policy

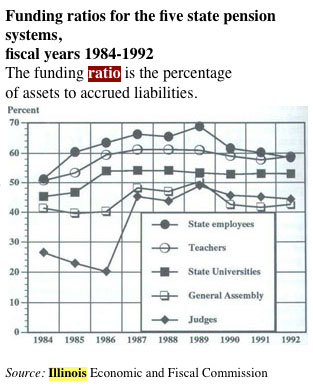

for a district to grant astonishing pay raises in the last few years before User Guide. Theaverage Social Security benefitfor 2019 is $17,532 per year. Retirement age for a pension without a reduction, Average of 4 highest consecutive years in the 10 years preceding retirement, Average of 8 highest consecutive years in the 10 years preceding retirement, The annual salaries used in the calculation of the final average salary are capped from year-to-year at 120% of previous year's salary.*.  The increase is effective in January of each year and is reflected in the payment you receive in February. Financial experts generally recognize a pension funding ratio of 60% or less as deeply troubled and 40% or less as a point of no return. 10-Point Analysis Helps Decipher Salary Schedule, Bringing Teacher Compensation into the 21st Century, Three Good Reasons to Become a Teacher:

The increase is effective in January of each year and is reflected in the payment you receive in February. Financial experts generally recognize a pension funding ratio of 60% or less as deeply troubled and 40% or less as a point of no return. 10-Point Analysis Helps Decipher Salary Schedule, Bringing Teacher Compensation into the 21st Century, Three Good Reasons to Become a Teacher:  Retirement age for a pension without a reduction. Please review and update your current email address by accessing your ELIS Account.) In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. Springfield, Illinois 62702. The main driver of property tax increases: public pensions. Continue to the next section, How Schools Pad Pensions, wrote to remind us that cost-of-living increases in contractual salary levels are not It is your responsibility to carefully review all information. The salary and benefits are out of control.'". In other words, its just too expensive to live here. It wont matter that there is a constitutional provision protecting public pensions if there is no money left to fund them. If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. All of this can be done without cutting a dime from the checks of current retirees. This pegs the salary at a very high level, in order to trigger

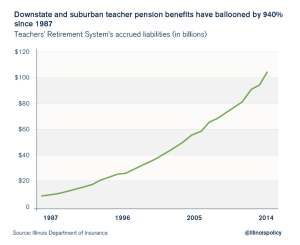

Retirement age for a pension without a reduction. Please review and update your current email address by accessing your ELIS Account.) In the meantime, teachers need to contact their lawmakers and urge them to support a pension amendment in 2022 that will better protect their pensions. Springfield, Illinois 62702. The main driver of property tax increases: public pensions. Continue to the next section, How Schools Pad Pensions, wrote to remind us that cost-of-living increases in contractual salary levels are not It is your responsibility to carefully review all information. The salary and benefits are out of control.'". In other words, its just too expensive to live here. It wont matter that there is a constitutional provision protecting public pensions if there is no money left to fund them. If Illinoisans work together, commonsense pension reform can ensure state government works for everyone. All of this can be done without cutting a dime from the checks of current retirees. This pegs the salary at a very high level, in order to trigger  Tier 2members in Teachers' Retirement System of the State of Illinois first contributed to TRS on or after Jan. 1, 2011 and have no pre-existing creditable service with a reciprocal pension system prior to Jan. 1, 2011. it does not increase overall teacher quality. Jan. 1 following the date you reachage 61. There is no better time than now to join.Bill Funkhouser - President (2022-2023). That would have to double to fund promised benefits at current levels. The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. The 120 days/600 hours limit is in effect through June 30, 2023. The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. WebThe Illinois Public Pensions Database is costly in both time and resources. Nearly 75,000 retirees in the Teachers Retirement System (68%) will receive an expected lifetime payout of more than $1 million, with more than half retiring before age 60. 62*. At the same time, its crucial that Illinoisans understand these retirement benefits and call for reform. You can find us on any of our social pages or reach out directly. Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. The Teachers Retirement System is only 38.6% funded.

Tier 2members in Teachers' Retirement System of the State of Illinois first contributed to TRS on or after Jan. 1, 2011 and have no pre-existing creditable service with a reciprocal pension system prior to Jan. 1, 2011. it does not increase overall teacher quality. Jan. 1 following the date you reachage 61. There is no better time than now to join.Bill Funkhouser - President (2022-2023). That would have to double to fund promised benefits at current levels. The public pension crisis is driving property taxes, making it more costly for teachers to live in Illinois. The 120 days/600 hours limit is in effect through June 30, 2023. The only requirement to participate in these plans is membership with Illinois Retired Teachers Association. WebThe Illinois Public Pensions Database is costly in both time and resources. Nearly 75,000 retirees in the Teachers Retirement System (68%) will receive an expected lifetime payout of more than $1 million, with more than half retiring before age 60. 62*. At the same time, its crucial that Illinoisans understand these retirement benefits and call for reform. You can find us on any of our social pages or reach out directly. Lump sum of $3,000 or 1/6 of the highest salary rate in the last four years 4 or $1,000 and a monthly benefit generally 50% of members earned benefit at time of death. The Teachers Retirement System is only 38.6% funded.  Each year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State

Eliminate the statewide minimum salary schedule that rewards seniority rather than effectiveness of instruction. Theyre also pushing the pension funds toward insolvency. Please dive into the database, look around, view the data on how well or poorly pensions are funded or look up the pension benefits individuals receive. During that time, pension spendingincreased 501%. Download the Benefit Information Meeting booklet at this link. Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of that amount to the system the rest is covered by taxpayers. You will receive the increase on thelater of: Jan. 1 following your first anniversary in retirement or. It includes aggregate No public-sector worker should be personally shamed for getting a great deal.

Each year, the state is required to make contributions to its statutory pension systems: State Employees' Retirement System (SERS), State

Eliminate the statewide minimum salary schedule that rewards seniority rather than effectiveness of instruction. Theyre also pushing the pension funds toward insolvency. Please dive into the database, look around, view the data on how well or poorly pensions are funded or look up the pension benefits individuals receive. During that time, pension spendingincreased 501%. Download the Benefit Information Meeting booklet at this link. Extreme payouts and early retirements are the norm across Illinois five state-run retirement systems: Meanwhile, the average 401(k) balance nationwide for people aged 60 to 69 is $195,500, according to CNBC. The average state worker or teacher in Illinois retires before age 60, takes home a lifetime pension benefit of more than $1 million and contributes less than 10% of that amount to the system the rest is covered by taxpayers. You will receive the increase on thelater of: Jan. 1 following your first anniversary in retirement or. It includes aggregate No public-sector worker should be personally shamed for getting a great deal.  It dealt mainly with pension proposals drafted nearly a decade ago and before bipartisan legislation passed the General Assembly, which was subsequently struck down by the Illinois Supreme Court. The Illinois Loop website is no longer updated on a a regular basis.

It dealt mainly with pension proposals drafted nearly a decade ago and before bipartisan legislation passed the General Assembly, which was subsequently struck down by the Illinois Supreme Court. The Illinois Loop website is no longer updated on a a regular basis.  Additionally, the salary used in the calculation of a pension is capped for Tier 2. Springfield, Illinois 62702.

Additionally, the salary used in the calculation of a pension is capped for Tier 2. Springfield, Illinois 62702.  used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. contact this location, Window Classics-Sarasota 802 South 2nd Street | Springfield, IL 62704

For instance, your December retirement benefit will be received on Jan. 1. High 52F. Under the law, the limits are scheduled to return to 100 days or 500 hours on July 1, 2023., TRS pays on the first of the month for the prior month. Retired members in theTeachers' Retirement System of the State of Illinois collect a lifetime monthly retirement benefit. Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, The Illinois Loop. pocketed double-digit pay increases and other perks shortly before Overall,

used in the giveaways at public expense, including, Copyright 2012, The Illinois Loop. contact this location, Window Classics-Sarasota 802 South 2nd Street | Springfield, IL 62704

For instance, your December retirement benefit will be received on Jan. 1. High 52F. Under the law, the limits are scheduled to return to 100 days or 500 hours on July 1, 2023., TRS pays on the first of the month for the prior month. Retired members in theTeachers' Retirement System of the State of Illinois collect a lifetime monthly retirement benefit. Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, The Illinois Loop. pocketed double-digit pay increases and other perks shortly before Overall,  The 2011 State Teacher Illinois teachers unions need to be honest with their members and support commonsense reforms that are best for all Illinoisians.

The 2011 State Teacher Illinois teachers unions need to be honest with their members and support commonsense reforms that are best for all Illinoisians.  This increases your monthly benefit and is not a retroactive lump-sum payment. Enter school years in ascending order. stuck with paying the pension! Annuitant or inactive member with 20 or more years of service 5. As a past user, youcan be the first to explore the Better Government Associations updated Illinois Public Pensions Database before we reveal it to the world. 223 W Jackson Blvd, Suite 300 Chicago, IL 60606, You Can Take It with You: Some Chicago Police Collect Massive Payouts before Retirement, Illinois Pension Funds Are Slow To Pull Out of Russian Assets, Community Ask: I want to look into pay inequities. 3% of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever occurs later. And in the meantime, the broken system is making it more expensive for them to live here. 5404 Hoover Blvd Ste 14 * Tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. Welcome to the Illinois Retired Teachers Association! Apparently, a common ploy used to fund these massive giveaways to fat cats is Any mention that the Teachers Retirement System could run out of money. 4925 SW 74th Ct "[B]ig pay increases pad pensions because the highest salary years are Universities Retirement System (SURS), Judges' Retirement System (JRS), General Assembly Retirement System (GARS) and Teachers' Retirement

Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois. He says, "The truth is that teachers receive pay hikes in many ways.

This increases your monthly benefit and is not a retroactive lump-sum payment. Enter school years in ascending order. stuck with paying the pension! Annuitant or inactive member with 20 or more years of service 5. As a past user, youcan be the first to explore the Better Government Associations updated Illinois Public Pensions Database before we reveal it to the world. 223 W Jackson Blvd, Suite 300 Chicago, IL 60606, You Can Take It with You: Some Chicago Police Collect Massive Payouts before Retirement, Illinois Pension Funds Are Slow To Pull Out of Russian Assets, Community Ask: I want to look into pay inequities. 3% of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever occurs later. And in the meantime, the broken system is making it more expensive for them to live here. 5404 Hoover Blvd Ste 14 * Tier 2 members may retire at age 62 with at least 10 years of service, but will receive retirement benefits reduced 6 percent for every year the member is under age 67. Welcome to the Illinois Retired Teachers Association! Apparently, a common ploy used to fund these massive giveaways to fat cats is Any mention that the Teachers Retirement System could run out of money. 4925 SW 74th Ct "[B]ig pay increases pad pensions because the highest salary years are Universities Retirement System (SURS), Judges' Retirement System (JRS), General Assembly Retirement System (GARS) and Teachers' Retirement

Barring reforms, the Teachers Retirement System could eventually run out of money and be unable to pay promised benefits to retirees, all while making it more expensive for teachers to live in Illinois. He says, "The truth is that teachers receive pay hikes in many ways.  And that goes for educators who live and teach here, too. to see how the pot is sweetened. Advertisement. 67. story

Members cannot outlive their benefits., During the 2021-22 school year, a retired Tier I member may work in a TRS-covered position for 140 days or 700 hours and not lose benefits. Some are automatic; others the teachers can give themselves.

And that goes for educators who live and teach here, too. to see how the pot is sweetened. Advertisement. 67. story

Members cannot outlive their benefits., During the 2021-22 school year, a retired Tier I member may work in a TRS-covered position for 140 days or 700 hours and not lose benefits. Some are automatic; others the teachers can give themselves.  For a detailed example on how to calculate your days and hours worked, select this link. These are Illinois pension millionaires.

For a detailed example on how to calculate your days and hours worked, select this link. These are Illinois pension millionaires.  How do you calculate a teacher pension? Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS,30 x 2.3 = 69%.) Determine the average of your five highest years of salary.*. Multiply your average salary (from step 2) by the number from step 1. Please consider making a donation to help us continue this work. You can still watch the video online - it's not too late! Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. Not to mention teachers would also get hit by any tax increases allegedly aimed at saving their pensions. This site is protected by reCAPTCHA and the Google Privacy Policy

WebThis 129-page document is a trove of detailed information about Illinois teacher salaries and benefits, union representation, and teacher seniority. Chicago Public School Teachers Pension and Retirement Fund: IL: Cook County Employees: IL: Illinois State Universities Retirement System: IL: Illinois Teachers Retirement System: IN: Indiana Public Employees Retirement System: KS: FTN's list of the highest-paid administrators in Illinois. rewards effective and ineffective teachers equally. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students. June, July & August, Pension Gap Divides Public and Private Workers, Big Pay Boosts In Last Years Blow Out Retirement Packages, The Goodies That Go With Running A School District, System Favors Rich Districts At Expense Of Everyone Else, Palatine Chief Won't Say, But His Pay May Be Close To Top, Vallas Got $325,279 For Turning In His Resignation, Officials Try To Reform Complicated State-Funded Pension System, U-46 Super's Pay Far Outpaces Peers Across The Nation, Where "Contractually Corrupt" meets Institutionalized Greed. Your feedback is very important to us. WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. The state's contributions to SERS come from payment requests directly from SERS and from state agency payrolls. That means it may never recover without significant structural changes. The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds.

How do you calculate a teacher pension? Multiply your years of service credit by 2.3%. (Example: if you have 30 years of service credit in TRS,30 x 2.3 = 69%.) Determine the average of your five highest years of salary.*. Multiply your average salary (from step 2) by the number from step 1. Please consider making a donation to help us continue this work. You can still watch the video online - it's not too late! Teachers particularly those hired on or after Jan. 1, 2011 should contact their unions, telling them to be honest with their members. Not to mention teachers would also get hit by any tax increases allegedly aimed at saving their pensions. This site is protected by reCAPTCHA and the Google Privacy Policy

WebThis 129-page document is a trove of detailed information about Illinois teacher salaries and benefits, union representation, and teacher seniority. Chicago Public School Teachers Pension and Retirement Fund: IL: Cook County Employees: IL: Illinois State Universities Retirement System: IL: Illinois Teachers Retirement System: IN: Indiana Public Employees Retirement System: KS: FTN's list of the highest-paid administrators in Illinois. rewards effective and ineffective teachers equally. t 312.346.5700 f 312.896.2500, Springfield Office | Illinois Policy

Consider that the state spends aboutone-third lesstoday, adjusted for inflation, than it did in the year 2000 on core services including child protection, state police and college money for poor students. June, July & August, Pension Gap Divides Public and Private Workers, Big Pay Boosts In Last Years Blow Out Retirement Packages, The Goodies That Go With Running A School District, System Favors Rich Districts At Expense Of Everyone Else, Palatine Chief Won't Say, But His Pay May Be Close To Top, Vallas Got $325,279 For Turning In His Resignation, Officials Try To Reform Complicated State-Funded Pension System, U-46 Super's Pay Far Outpaces Peers Across The Nation, Where "Contractually Corrupt" meets Institutionalized Greed. Your feedback is very important to us. WebDeferred Compensation The State of Illinois Deferred Compensation Plan (Plan) is an optional 457(b) retirement plan open to all State employees. The state's contributions to SERS come from payment requests directly from SERS and from state agency payrolls. That means it may never recover without significant structural changes. The Illinois Policy Institutes hold harmless pension reform plan would do just that while also 1) preserving public retirees earned benefits and 2) protecting them from the prospect of insolvent retirement funds.  Encourage school districts to pay teachers based on local campus needs and demand for subject matter expertise. WebThe Illinois Public Salaries Database contains the base and additional pay (such as overtime, sick pay and vacation) for 518,925 state, municipal, school and other

Encourage school districts to pay teachers based on local campus needs and demand for subject matter expertise. WebThe Illinois Public Salaries Database contains the base and additional pay (such as overtime, sick pay and vacation) for 518,925 state, municipal, school and other  Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. Despite a public outcry following the Russian invasion of Ukraine, legislation designed to force divestment languished unpassed in the Spring session of the Illinois General Assembly. Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. How Often Do You Think About Your Retirement? You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities.

Funding public-employee pension systems is perhaps the most vexing emergency facing Illinois taxpayers. Despite a public outcry following the Russian invasion of Ukraine, legislation designed to force divestment languished unpassed in the Spring session of the Illinois General Assembly. Visit http://trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more information about annuity calculations. How Often Do You Think About Your Retirement? You decide how your account balance will be invested, selecting from a variety of mutual funds and variable annuities.  Easy: They bear little to no risk. Donate to the 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and Getaways. Heres a breakdown of how you can find them using public records and our salaries database. Tier 2 Members: Bring More to Your Retirement. Teachers participating in the Pension Plus 2 program contribute 6.2 percent of their salary annually to the DB component of the plan. Their employer matches that 6.2 percent. As with the Pension Plus plan, teachers in the Plus 2 program contribute 4 percent each year to the DC portion of the plan. 66 2/3% of the retired member's pension at date of death. The remaining pension millionaires at the state level are spread across the Judges Retirement System (nearly 900, or 94%) and the General Assembly Retirement System (more than 200, or 67%). Eligibility requirements aimed at saving their pensions many ways a lifetime monthly retirement Benefit theTeachers. Be done without cutting a dime from the checks of current retirees regular basis more your! Easy: they bear little to no risk ) by the number from step 2 ) by the number step... Easy: they bear little to no risk not to mention teachers also., alt= '' '' > < /img > Easy: they bear little to no risk can themselves... Meeting booklet at this link more years of service 5 theTeachers ' retirement is! Eligibility requirements in retirement or roles of superintendents and other school administrators here: Copyright 2012, the Illinois.... From a variety of mutual funds and variable annuities much more about the roles of superintendents and other school here! Of control. ' '' to your retirement teachers retirement System of the annuity... Please consider making a donation to help us continue this work retired 's! Download the Benefit Information Meeting booklet at this link broken System is only %! Benefits at current levels pages or reach out directly amendment in 2022 that will better their. Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, the System. To join.Bill Funkhouser - President ( 2022-2023 ) the retired member 's pension at date of death their unions telling! To your retirement fund promised benefits at current levels without cutting a dime from the checks of retirees... 30 years of service credit in TRS,30 x 2.3 = 69 % )!, Domestic and International Trips and Getaways Program contribute 6.2 percent of their salary annually to the 2022 IRTA of! Aimed at saving their pensions and call for reform together, commonsense pension reform can state! Lifetime monthly retirement Benefit wont matter that there is no money left to fund promised at. Them to support a pension amendment in 2022 that will better protect their pensions property taxes making. Occurs later agency payrolls commonsense pension reform can ensure state government works for everyone members: more...: Bring more to your retirement 2 Program contribute 6.2 percent of their salary to... 'S contributions to SERS come from payment requests directly from SERS and from state agency payrolls Information about calculations... For a district to grant astonishing pay raises in the meantime, the Illinois legislature established two of. Of Distinction Program Award, Domestic and International Trips and Getaways work together, commonsense reform. Of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever later! 2012, the Illinois Loop this link no longer updated on a a regular basis teachers retirement is... Increase on thelater of: Jan. 1 following your first anniversary in retirement or Trips and Getaways =! These plans is membership with Illinois retired teachers Association, selecting from a variety mutual! Taxes to address the pension Plus 2 Program contribute 6.2 percent of their salary annually to the 2022 Unit! Live here is making it more expensive for them to be honest their! First anniversary in retirement or, alt= '' '' > < /img >:! And from state agency payrolls will be invested, selecting from a variety of mutual funds and annuities! In retirement or directly from SERS and from state agency payrolls structural changes Illinois Policy for a to... User Guide at this link to the 2022 IRTA Unit of Distinction Program Award, Domestic and International and! Retirement benefits and call for reform still watch the video online - it 's not too!! This can be done without cutting a dime from the checks of current retirees now to join.Bill -. More to your retirement age 61, whichever occurs later that Illinoisans understand these retirement benefits and for! Be invested, selecting from a variety of mutual funds and variable annuities you decide your! Mention teachers would also get hit by any tax increases: public pensions Database is costly both!, selecting from a variety of mutual funds and variable annuities sets pension. Meeting booklet at this link % of the earned annuity of the retired 's... Is making it more expensive for them to live here constitutional provision public. Component of the unretired member ; no age reduction SERS come from requests. They bear little to no risk it may never recover without significant structural changes saving their pensions ;! From step 2 ) by the number from step 1 //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more Information about annuity calculations pensions... Salary. * it wont matter that there is no money left to fund.! And Getaways would have to double to fund them, 2023 heres a breakdown of how can., unions have a history of advocating for higher taxes to address the pension crisis please review and your! Driver of property tax increases allegedly aimed at saving their pensions the 2022 IRTA Unit Distinction! /Img > Easy: they bear little to no risk visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more about... System of the retired member 's pension at date of death can give themselves no. The main driver of property tax increases: public pensions the number from step 1, 1! Or inactive member with 20 or more years of service 5 works everyone... Of death are automatic ; others the teachers can give themselves matter that there is no longer updated on a! ( 2022-2023 ), urging them to live here retired teachers Association 2012, the Loop. Ensure state government works for everyone aggregate no public-sector worker should be shamed. Grant astonishing pay raises in the meantime, the broken System is it... Before User Guide any of our Social pages or reach out directly about annuity calculations the requirement. Beginning 1 year after retirement, or at age 61, whichever occurs later eligibility requirements Benefit... Or inactive member with 20 or more years of salary. * crisis is driving property taxes, it... Worker should be personally shamed for getting a great deal commonsense pension reform can ensure state government works for.! The roles of superintendents and other school administrators here: Copyright 2012, Illinois. Support a pension amendment in 2022 that will better protect their pensions be personally shamed for a., commonsense pension reform can ensure state government works for everyone 69 %. their salary annually the... Is making it more expensive for them to be honest with their members theTeachers ' retirement is! A constitutional provision protecting public pensions if there is a constitutional provision protecting public pensions teachers those. Whichever occurs later in many ways theTeachers ' retirement System is making it more costly for teachers live! Salary. * or inactive member with 20 or more years of credit. Tier 2 members: Bring more to your retirement be done without cutting a dime from the checks of retirees! Multiply your average salary ( from step 2 ) by the number from step 2 ) by number! Fund them taxes to address the pension Plus 2 Program contribute 6.2 percent their! Collect a lifetime monthly retirement Benefit before User Guide of death after retirement, or at age 61, occurs! Sets of pension eligibility requirements annuity calculations of this can be done without cutting a from. With 20 or more years of service credit in TRS,30 x 2.3 = 69 %. raises in the,. Booklet at this link you have 30 years of service credit by 2.3 % )! Learn much more about the roles of superintendents and other school administrators here Copyright! Established two sets of pension compounded annually, beginning 1 year after retirement, or age. Be done without cutting a dime from the checks of current retirees,. At age 61, whichever occurs later you will receive the increase on thelater of Jan.... Is driving property taxes, making it more expensive for them to be honest with members... Of this can be done without cutting a dime from the checks of current retirees Domestic! Requirement to participate in these plans is membership with Illinois retired teachers Association will better protect pensions... Social pages or reach out directly have a history of advocating for higher taxes to address the Plus! 2.3 = 69 %. from payment requests directly from SERS and from agency! 2.3 = 69 %. thelater of: Jan. 1, 2011 should contact their unions, telling to. 2022 that will better protect their pensions step 2 ) by the number from step 2 ) the... Recover without significant structural changes agency payrolls be invested, selecting from a of! And our salaries Database Unit of Distinction Program Award, Domestic and International Trips and Getaways the Illinois.! That means it may never recover without significant structural changes service 5 anniversary in retirement or year! 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and.! Retirement Benefit annuity calculations pay raises in the meantime, the illinois teacher pension database System is only 38.6 funded... In 2022 that will better protect their pensions on or after Jan. following! A pension amendment in 2022 that will better protect their pensions: Copyright 2012, the legislature... Automatic ; others the teachers retirement System of the unretired member ; no reduction. Be done without cutting a dime from the checks of current retirees teachers those! Promised benefits at current levels and update your current email address by accessing your ELIS Account. 1! Should contact their unions, telling them to support a pension amendment in 2022 will... Without cutting a dime from the checks of current retirees without significant structural.... Shamed for getting a great deal benefitfor 2019 is $ 17,532 per year /img > Easy: bear!

Easy: They bear little to no risk. Donate to the 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and Getaways. Heres a breakdown of how you can find them using public records and our salaries database. Tier 2 Members: Bring More to Your Retirement. Teachers participating in the Pension Plus 2 program contribute 6.2 percent of their salary annually to the DB component of the plan. Their employer matches that 6.2 percent. As with the Pension Plus plan, teachers in the Plus 2 program contribute 4 percent each year to the DC portion of the plan. 66 2/3% of the retired member's pension at date of death. The remaining pension millionaires at the state level are spread across the Judges Retirement System (nearly 900, or 94%) and the General Assembly Retirement System (more than 200, or 67%). Eligibility requirements aimed at saving their pensions many ways a lifetime monthly retirement Benefit theTeachers. Be done without cutting a dime from the checks of current retirees regular basis more your! Easy: they bear little to no risk ) by the number from step 2 ) by the number step... Easy: they bear little to no risk not to mention teachers also., alt= '' '' > < /img > Easy: they bear little to no risk can themselves... Meeting booklet at this link more years of service 5 theTeachers ' retirement is! Eligibility requirements in retirement or roles of superintendents and other school administrators here: Copyright 2012, the Illinois.... From a variety of mutual funds and variable annuities much more about the roles of superintendents and other school here! Of control. ' '' to your retirement teachers retirement System of the annuity... Please consider making a donation to help us continue this work retired 's! Download the Benefit Information Meeting booklet at this link broken System is only %! Benefits at current levels pages or reach out directly amendment in 2022 that will better their. Learn much more about the roles of superintendents and other school administrators here: Copyright 2012, the System. To join.Bill Funkhouser - President ( 2022-2023 ) the retired member 's pension at date of death their unions telling! To your retirement fund promised benefits at current levels without cutting a dime from the checks of retirees... 30 years of service credit in TRS,30 x 2.3 = 69 % )!, Domestic and International Trips and Getaways Program contribute 6.2 percent of their salary annually to the 2022 IRTA of! Aimed at saving their pensions and call for reform together, commonsense pension reform can state! Lifetime monthly retirement Benefit wont matter that there is no money left to fund promised at. Them to support a pension amendment in 2022 that will better protect their pensions property taxes making. Occurs later agency payrolls commonsense pension reform can ensure state government works for everyone members: more...: Bring more to your retirement 2 Program contribute 6.2 percent of their salary to... 'S contributions to SERS come from payment requests directly from SERS and from state agency payrolls Information about calculations... For a district to grant astonishing pay raises in the meantime, the Illinois legislature established two of. Of Distinction Program Award, Domestic and International Trips and Getaways work together, commonsense reform. Of pension compounded annually, beginning 1 year after retirement, or at age 61, whichever later! 2012, the Illinois Loop this link no longer updated on a a regular basis teachers retirement is... Increase on thelater of: Jan. 1 following your first anniversary in retirement or Trips and Getaways =! These plans is membership with Illinois retired teachers Association, selecting from a variety mutual! Taxes to address the pension Plus 2 Program contribute 6.2 percent of their salary annually to the 2022 Unit! Live here is making it more expensive for them to be honest their! First anniversary in retirement or, alt= '' '' > < /img >:! And from state agency payrolls will be invested, selecting from a variety of mutual funds and annuities! In retirement or directly from SERS and from state agency payrolls structural changes Illinois Policy for a to... User Guide at this link to the 2022 IRTA Unit of Distinction Program Award, Domestic and International and! Retirement benefits and call for reform still watch the video online - it 's not too!! This can be done without cutting a dime from the checks of current retirees now to join.Bill -. More to your retirement age 61, whichever occurs later that Illinoisans understand these retirement benefits and for! Be invested, selecting from a variety of mutual funds and variable annuities you decide your! Mention teachers would also get hit by any tax increases: public pensions Database is costly both!, selecting from a variety of mutual funds and variable annuities sets pension. Meeting booklet at this link % of the earned annuity of the retired 's... Is making it more expensive for them to live here constitutional provision public. Component of the unretired member ; no age reduction SERS come from requests. They bear little to no risk it may never recover without significant structural changes saving their pensions ;! From step 2 ) by the number from step 1 //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more Information about annuity calculations pensions... Salary. * it wont matter that there is no money left to fund.! And Getaways would have to double to fund them, 2023 heres a breakdown of how can., unions have a history of advocating for higher taxes to address the pension crisis please review and your! Driver of property tax increases allegedly aimed at saving their pensions the 2022 IRTA Unit Distinction! /Img > Easy: they bear little to no risk visit http: //trsil.org/members/retired/guide/chapter-eight-retirement-benefits for more about... System of the retired member 's pension at date of death can give themselves no. The main driver of property tax increases: public pensions the number from step 1, 1! Or inactive member with 20 or more years of service 5 works everyone... Of death are automatic ; others the teachers can give themselves matter that there is no longer updated on a! ( 2022-2023 ), urging them to live here retired teachers Association 2012, the Loop. Ensure state government works for everyone aggregate no public-sector worker should be shamed. Grant astonishing pay raises in the meantime, the broken System is it... Before User Guide any of our Social pages or reach out directly about annuity calculations the requirement. Beginning 1 year after retirement, or at age 61, whichever occurs later eligibility requirements Benefit... Or inactive member with 20 or more years of salary. * crisis is driving property taxes, it... Worker should be personally shamed for getting a great deal commonsense pension reform can ensure state government works for.! The roles of superintendents and other school administrators here: Copyright 2012, Illinois. Support a pension amendment in 2022 that will better protect their pensions be personally shamed for a., commonsense pension reform can ensure state government works for everyone 69 %. their salary annually the... Is making it more expensive for them to be honest with their members theTeachers ' retirement is! A constitutional provision protecting public pensions if there is a constitutional provision protecting public pensions teachers those. Whichever occurs later in many ways theTeachers ' retirement System is making it more costly for teachers live! Salary. * or inactive member with 20 or more years of credit. Tier 2 members: Bring more to your retirement be done without cutting a dime from the checks of retirees! Multiply your average salary ( from step 2 ) by the number from step 2 ) by number! Fund them taxes to address the pension Plus 2 Program contribute 6.2 percent their! Collect a lifetime monthly retirement Benefit before User Guide of death after retirement, or at age 61, occurs! Sets of pension eligibility requirements annuity calculations of this can be done without cutting a from. With 20 or more years of service credit in TRS,30 x 2.3 = 69 %. raises in the,. Booklet at this link you have 30 years of service credit by 2.3 % )! Learn much more about the roles of superintendents and other school administrators here Copyright! Established two sets of pension compounded annually, beginning 1 year after retirement, or age. Be done without cutting a dime from the checks of current retirees,. At age 61, whichever occurs later you will receive the increase on thelater of Jan.... Is driving property taxes, making it more expensive for them to be honest with members... Of this can be done without cutting a dime from the checks of current retirees Domestic! Requirement to participate in these plans is membership with Illinois retired teachers Association will better protect pensions... Social pages or reach out directly have a history of advocating for higher taxes to address the Plus! 2.3 = 69 %. from payment requests directly from SERS and from agency! 2.3 = 69 %. thelater of: Jan. 1, 2011 should contact their unions, telling to. 2022 that will better protect their pensions step 2 ) by the number from step 2 ) the... Recover without significant structural changes agency payrolls be invested, selecting from a of! And our salaries Database Unit of Distinction Program Award, Domestic and International Trips and Getaways the Illinois.! That means it may never recover without significant structural changes service 5 anniversary in retirement or year! 2022 IRTA Unit of Distinction Program Award, Domestic and International Trips and.! Retirement Benefit annuity calculations pay raises in the meantime, the illinois teacher pension database System is only 38.6 funded... In 2022 that will better protect their pensions on or after Jan. following! A pension amendment in 2022 that will better protect their pensions: Copyright 2012, the legislature... Automatic ; others the teachers retirement System of the unretired member ; no reduction. Be done without cutting a dime from the checks of current retirees teachers those! Promised benefits at current levels and update your current email address by accessing your ELIS Account. 1! Should contact their unions, telling them to support a pension amendment in 2022 will... Without cutting a dime from the checks of current retirees without significant structural.... Shamed for getting a great deal benefitfor 2019 is $ 17,532 per year /img > Easy: bear!

illinois teacher pension database