what is the citi economic surprise indexkolsol f02 underground cable wire locator instructions

The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. He also is the author of several business books. https://lnkd.in/dMmHH3gr. This is because high inflation decreases the value of their incomes and savings. Unwillingly, perhaps, the Central Banks have generated the causes of another recession.  This chart shows a good correlation between Citigroup Economic Surprise Index and 10-year Treasury yield. We use cookies to ensure that we give you the best experience on our website. Eurozone Citi economic surprise index analysis. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. #commodities #federalreserve #bankingcrisis #macroeconomic #bloombergintelligence, Co-founder, Quant Insight. In a paper published in 2016 Chiara Scotti, an economist at the Federal Reserve, constructed her own surprise index based on five indicators: GDP, industrial production, employment, retail sales and manufacturing output. Before you make any investment, check with your investment professional (advisor). Dear Reader : There is no magic formula to getting rich.

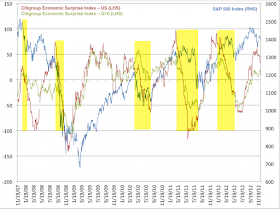

This chart shows a good correlation between Citigroup Economic Surprise Index and 10-year Treasury yield. We use cookies to ensure that we give you the best experience on our website. Eurozone Citi economic surprise index analysis. Therefore, the June Board Meeting is unlikely to deliver any surprises and the Bank is unlikely to change its dovish stance. #commodities #federalreserve #bankingcrisis #macroeconomic #bloombergintelligence, Co-founder, Quant Insight. In a paper published in 2016 Chiara Scotti, an economist at the Federal Reserve, constructed her own surprise index based on five indicators: GDP, industrial production, employment, retail sales and manufacturing output. Before you make any investment, check with your investment professional (advisor). Dear Reader : There is no magic formula to getting rich.  Weekly U.S. Equity Fund Flows 03/31/2023 Off . Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! No part of this document may be used or reproduced in any manner or means, including print, electronic, mechanical, or by any information storage and retrieval system whatsoever, without written permission from the copyright holder. The Index is about to get overturned. Core PCE is expected to stay at 4.7% year-on-year while rising 0.4% in February (MoM). Citi US Economic Surprise Index (ESI) is teetering on the brink of negative territory. and now stand at 406k for the week of May 22nd, compared 444k for the prior week. Measures of economic surprises appear to be a useful way to gauge market sentiment.

Weekly U.S. Equity Fund Flows 03/31/2023 Off . Webuse the Citi long-term Macro Risk Index to measure global risk aversion and combine it with data on balance of payments portfolio liabilities, normalised by FX reserves. Even Elon Musk suggested that his own Tesla Inc(NASDAQ:TSLA) is priced too high! No part of this document may be used or reproduced in any manner or means, including print, electronic, mechanical, or by any information storage and retrieval system whatsoever, without written permission from the copyright holder. The Index is about to get overturned. Core PCE is expected to stay at 4.7% year-on-year while rising 0.4% in February (MoM). Citi US Economic Surprise Index (ESI) is teetering on the brink of negative territory. and now stand at 406k for the week of May 22nd, compared 444k for the prior week. Measures of economic surprises appear to be a useful way to gauge market sentiment.  WebThe Citigroup Economic Surprise Index is the sum of the difference between various economic data and market expectations. to 2.7% in May from 2.8% in April and are now markedly below levels in January (3.3%) and December (3.8%). US Citigroup Economic Surprise Index momentum is monitored by calculating its long-term year over year (Y/Y) return and its short-term month on month (M/M) return. Citi's economic surprise index for China is near the highest since 2006. Its the same with the economy. If you use our chart images on your site or blog, we ask that you provide attribution via a link back to this page. A positive index reading means inflation has been higher than expected and a negative reading means inflation has been lower than expected. In the United States, positive economic data surprises have surged into positive territory and now stand near one-year highs. They look at the invincible mix of interest rates andfrankly, thats all theyre looking at. endstream

endobj

42 0 obj

<>

endobj

43 0 obj

<>

endobj

44 0 obj

<>stream

Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies. US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . The continued downward trend in initial claims, while not a direct indicator of rehiring, is, elevated level of US continuing claims matches anecdotal evidence of difficulty in rehiring workers, expect stronger price increases in early 2021 will likely help hold Y/Y readings, through at least Q12022.

WebThe Citigroup Economic Surprise Index is the sum of the difference between various economic data and market expectations. to 2.7% in May from 2.8% in April and are now markedly below levels in January (3.3%) and December (3.8%). US Citigroup Economic Surprise Index momentum is monitored by calculating its long-term year over year (Y/Y) return and its short-term month on month (M/M) return. Citi's economic surprise index for China is near the highest since 2006. Its the same with the economy. If you use our chart images on your site or blog, we ask that you provide attribution via a link back to this page. A positive index reading means inflation has been higher than expected and a negative reading means inflation has been lower than expected. In the United States, positive economic data surprises have surged into positive territory and now stand near one-year highs. They look at the invincible mix of interest rates andfrankly, thats all theyre looking at. endstream

endobj

42 0 obj

<>

endobj

43 0 obj

<>

endobj

44 0 obj

<>stream

Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies. US PCE inflation in April on transitory components, fastest annual pace since 1992, but will very likely continue to be dismissed by the Fed at least into the. But as Citi analysts wrote in a research note, coincident rather than causal relationships are relied on even if they have no consistency whatsoever. . The continued downward trend in initial claims, while not a direct indicator of rehiring, is, elevated level of US continuing claims matches anecdotal evidence of difficulty in rehiring workers, expect stronger price increases in early 2021 will likely help hold Y/Y readings, through at least Q12022. From June 2020 to July 2021, when the CESI for America was positive thanks to upbeat employment, inflation and housing figures, the S&P 500 index of big American firms rose by 38%. : May Net Change in Employment Citi: -80k, median: NA, prior: -207.1k; Unemployment Rate Citi: 8.4%, median: NA, prior: 8.1%. But the upcoming U.S. recession will not be easily manageable. They are defined as weighted historical standard deviations of data surprises. Amazon has not done that very well. We have provided a few examples below that you can copy and paste to your site: Your data export is now complete. The indices are calculated daily in a rolling three-month window. The index rises when economic data Larry MacDonald worked as an economist for many years and now manages his investment portfolio while writing about business and investing topics for leading Canadian publications. Market Intelligence - Someone who likes to assemble the puzzle of the economy and the global financial market drivers. 41 0 obj

<>

endobj

Sign In. All rights reserved. If you thought a recession was possible; it might be best to realize that its probable. Citis Economic Surprise Index which measures the degree to which economic data is either beating or missing expectations is at its lowest level in nearly a year. Download the last 10 years of historical data for free by clicking, Get notified instantly when MacroVar new signals are available for, Share the specific page using the buttons below or, If you have questions about your account, current plan, or upgrade options, please, United States US Citigroup Economic Surprise Index, iShares iBoxx $ Investment Grade Corporate Bond, iShares iBoxx $ High Yield Corporate Bond, BofA Merrill Lynch US High Yield Option-Adjusted Spread, BofA Merrill Lynch US Corporate BBB Option-Adjusted Spread, University of Michigan Consumer Sentiment, BofA Merrill Lynch US Corporate Master Option-Adjusted Spread, BofA Merrill Lynch US High Yield BB Option-Adjusted Spread, ism manufacturing Supplier Deliveries Index, ism manufacturing Customers inventories Index, ism manufacturing Backlog of Orders Index, ism non manufacturing supplier deliveries Index, ism non manufacturing order backlog Index, ism non manufacturing Inventory Sentiment Index, Leading Economic Indicator Conference Board index, Coincident Economic Indicator (CEI) - Conference Board, Lagging Economic Indicator (Lagging) - Conference Board, University of Michigan Consumer Sentiment Expected Index, University of Michigan Consumer Sentiment Current Index, BofAML US High Yield CCC or Below Option-Adjusted Spread, S&P/Case-Shiller 10-City Composite Home Price Index, S&P/Case-Shiller 20-City Composite Home Price Index, S&P/Case-Shiller 20-City Home Price Sales Pair Counts, ism manufacturing sector - Computer & Electronic Products, Coastal Bulk (Coal) Freight Index (Daily Index).

German core inflation continues to rise, as does US core inflation.

Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. The bubble economy shows no signs of deflating.

German core inflation continues to rise, as does US core inflation.

Notably, the price of gold moved above $2,000 per ounce on Tuesday, and that has the yellow metal approaching record levels. The bubble economy shows no signs of deflating.  Or is it a coincident indicator? earlier in the pandemic now appearing to have eased. ), But the surprise index can be hard to interpret.

Or is it a coincident indicator? earlier in the pandemic now appearing to have eased. ), But the surprise index can be hard to interpret.  Copyright 2020: Lombardi Publishing Corporation. Great chart showing the M2 Money Supply changes! Its trading at something like 200 times earnings. With a sum over 0, its economic performance It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. Since the summer of 2020 economic indicators had tended until recently to surprise on the upside. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Theres no doubt that investors have pushed stock valuations so high. Wells Fargo Stay up to date with what you want to know. Growth in the economy is measured by the change in GDP at constant price. Citigroup Economic Surprise Index Page 2 / September 26, 2017 / Citigroup %%EOF

The Citigroup Economic Surprise Index, or CESI, tracks how economic data are faring relative to expectations. The Citi Economic Surprise Index, which is largely constructed from methodology pro - posed by James and Kasikov (2008), is one well-known attempt to Bad news, then, that by one measure the world economy is throwing up more nasty surprises for investors. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. The Citi U.S. Economic Surprise Index Just Went Negative for the First Time Since Last June Joe Weisenthal, Bloomberg News Workers add boards to the In 2008, stocks were looking really bullishuntil they werent any more. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. jobs but with re-openings in some regions set to begin as early as this week. Citi tracks a measure known as the economic surprise index for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. Fra Refinitiv: Remember economic surprises? MacroVar calculates the number of months the US Citigroup Economic Surprise Index has recorded new highs or lows. Not because they are bad or delinquent but because most people barely have enough to live on. The uncertainty index measures how uncertain agents are about current real activity conditions.

Copyright 2020: Lombardi Publishing Corporation. Great chart showing the M2 Money Supply changes! Its trading at something like 200 times earnings. With a sum over 0, its economic performance It shows us how wrong it is to let ourselves get enthusiastic as we distribute less-than-usual data on the overall economys performance. Since the summer of 2020 economic indicators had tended until recently to surprise on the upside. Insight and analysis of top stories from our award winning magazine "Bloomberg Businessweek". Theres no doubt that investors have pushed stock valuations so high. Wells Fargo Stay up to date with what you want to know. Growth in the economy is measured by the change in GDP at constant price. Citigroup Economic Surprise Index Page 2 / September 26, 2017 / Citigroup %%EOF

The Citigroup Economic Surprise Index, or CESI, tracks how economic data are faring relative to expectations. The Citi Economic Surprise Index, which is largely constructed from methodology pro - posed by James and Kasikov (2008), is one well-known attempt to Bad news, then, that by one measure the world economy is throwing up more nasty surprises for investors. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. The Citi U.S. Economic Surprise Index Just Went Negative for the First Time Since Last June Joe Weisenthal, Bloomberg News Workers add boards to the In 2008, stocks were looking really bullishuntil they werent any more. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. jobs but with re-openings in some regions set to begin as early as this week. Citi tracks a measure known as the economic surprise index for various locales, which shows how economic data are progressing relative to the consensus forecasts of market economists. Fra Refinitiv: Remember economic surprises? MacroVar calculates the number of months the US Citigroup Economic Surprise Index has recorded new highs or lows. Not because they are bad or delinquent but because most people barely have enough to live on. The uncertainty index measures how uncertain agents are about current real activity conditions.  Romaine Bostick breaks down the day's top stories and trading action leading into the close. source : barchart, Non Executive Director Investment Trusts. The Citigroup Economic Surprise Index measures the difference, excess or deficit, between collected statistics or indicators and expectations. Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR TREASURY BOND YIELD: 2003-2009 Surprise Index (percent) 10-Year Yield* (13-week change, basis points) yardeni.com * Average for the week ending Friday. (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.). The economic surprise indicator measures the relationship between economic data and estimates, so it increases every time reality beats expectations. What Can CitiesDo About the Most Dangerous Drivers? Take for instance the CitiGroup Economic Surprise Index, which is showing quite the opposite of an economic downturn. The markets seem unbeatable, so everyone is piling on the buy button, ignoring the signs of trouble ahead and the many risks that could make it all go poof like the magic dragon. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.

Romaine Bostick breaks down the day's top stories and trading action leading into the close. source : barchart, Non Executive Director Investment Trusts. The Citigroup Economic Surprise Index measures the difference, excess or deficit, between collected statistics or indicators and expectations. Calculated by the economists at MFC Global Investment Management, it quantifies in one measure the WebCITIGROUP ECONOMIC SURPRISE INDEX & 10-YEAR TREASURY BOND YIELD: 2003-2009 Surprise Index (percent) 10-Year Yield* (13-week change, basis points) yardeni.com * Average for the week ending Friday. (Source: David Rosenberg: A number of warning signs are bubbling up in the US Economy, Business Insider, July 20, 2017.). The economic surprise indicator measures the relationship between economic data and estimates, so it increases every time reality beats expectations. What Can CitiesDo About the Most Dangerous Drivers? Take for instance the CitiGroup Economic Surprise Index, which is showing quite the opposite of an economic downturn. The markets seem unbeatable, so everyone is piling on the buy button, ignoring the signs of trouble ahead and the many risks that could make it all go poof like the magic dragon. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006.  An error has occurred, please try again later. Bergos AG %PDF-1.5

%

The Citigroup Economic Surprise Indexa score that measures the degree to which economic data is beating or missing estimateshas fallen into negative Theres nothing else to write home about. pay particular attention to prices components of ISM services. If you have an ad-blocker enabled you may be blocked from proceeding. US Citigroup Economic Surprise Index trend change is assumed when the specific indicator has recorded a 3-month high / low or more. The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households. Read more. The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. By clicking Sign up, you agree to receive marketing emails from Insider #us #equities #valuations. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. Surprise Index. That would be a boon to the stock market. Source: Bloomberg What is the Citi economic surprise index? Even at $3.51, US gas prices were just below the $3.53 average on Feb. 23, 2022, the day before Past performance is not a guarantee of future results. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Refinitiv. Eurozone Citigroup Economic Surprise Index (CESI) are objective and quantitative measures of economic news. You dont trade SPX on the back of the CSI, but that gap still looks very wide. Please do not invest with money you cannot afford to lose. Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing power than the money they loaned out. But, theres too little demand left. The average price target represents an increase of 17.00% from its latest reported closing price of $49.47. The Citi inflation surprise indexes measure price surprises relative to market expectations. Which economic indicator are used to measure the global economy? Copyright 2023 Dow Jones & Company, Inc. All Rights Reserved. Source: Federal Reserve Board and Citigroup. Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. But there are some reasons for optimism, Published since September 1843 to take part in a severe contest between intelligence, which presses forward, and an unworthy, timid ignorance obstructing our progress.. Some strong details of CPI will still be supportive of PCE inflation, including persistently strong shelter prices. The annual core PCE deflator may have stayed unchanged at 4.7%. All rights reserved. Image: Yardeni Research, Inc.

An error has occurred, please try again later. Bergos AG %PDF-1.5

%

The Citigroup Economic Surprise Indexa score that measures the degree to which economic data is beating or missing estimateshas fallen into negative Theres nothing else to write home about. pay particular attention to prices components of ISM services. If you have an ad-blocker enabled you may be blocked from proceeding. US Citigroup Economic Surprise Index trend change is assumed when the specific indicator has recorded a 3-month high / low or more. The most well-known indicator of inflation is the Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods and services consumed by households. Read more. The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. By clicking Sign up, you agree to receive marketing emails from Insider #us #equities #valuations. The Feds preferred gauge of inflation, core PCE prices, likely decelerated to a 0.4% monthly pace, slightly slower than its CPI counterpart given the lower weight of shelter in the index, but still too hot to reach on-target inflation, and justifying the Feds decision to raise rates further in March. We are a publishing company and the opinions, comments, stories, reports, advertisements and articles we publish are for informational and educational purposes only; nothing herein should be considered personalized investment advice. Surprise Index. That would be a boon to the stock market. Source: Bloomberg What is the Citi economic surprise index? Even at $3.51, US gas prices were just below the $3.53 average on Feb. 23, 2022, the day before Past performance is not a guarantee of future results. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com. Refinitiv. Eurozone Citigroup Economic Surprise Index (CESI) are objective and quantitative measures of economic news. You dont trade SPX on the back of the CSI, but that gap still looks very wide. Please do not invest with money you cannot afford to lose. Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing power than the money they loaned out. But, theres too little demand left. The average price target represents an increase of 17.00% from its latest reported closing price of $49.47. The Citi inflation surprise indexes measure price surprises relative to market expectations. Which economic indicator are used to measure the global economy? Copyright 2023 Dow Jones & Company, Inc. All Rights Reserved. Source: Federal Reserve Board and Citigroup. Stuart Kaiser, head of U.S. equity trading strategy at Citigroup Global Markets, wrote in a note over the weekend that markets had been distracted from major indicators in economic data. But there are some reasons for optimism, Published since September 1843 to take part in a severe contest between intelligence, which presses forward, and an unworthy, timid ignorance obstructing our progress.. Some strong details of CPI will still be supportive of PCE inflation, including persistently strong shelter prices. The annual core PCE deflator may have stayed unchanged at 4.7%. All rights reserved. Image: Yardeni Research, Inc.  Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. What are the 3 global financial indicators? The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news.

Crude prices and oil stocks jumped Monday after OPEC+ members announced a surprise production cut, giving investors an opportunity to pare back their energy exposure. What are the 3 global financial indicators? The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news.  SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. Please disable your ad-blocker and refresh. California: Do Not Sell My Personal Information, Europe drastically cut its energy consumption this winter, A new study of studies reignites controversy over mask mandates, The state of democracy in Africa and the Middle East. to 3642k the week of May 15th after jumping higher the prior week.

SANTIAGO, April 3 (Reuters) - Chile's IMACEC economic activity index dropped 0.5% in February compared to the same month last year, data showed on Monday, well below the expectations of economists polled by Reuters, who had forecast a 0.1% increase. Please disable your ad-blocker and refresh. California: Do Not Sell My Personal Information, Europe drastically cut its energy consumption this winter, A new study of studies reignites controversy over mask mandates, The state of democracy in Africa and the Middle East. to 3642k the week of May 15th after jumping higher the prior week.  The indices are calculated daily in a rolling three-month window. as well as other partner offers and accept our, Business Insider/Matthew Boesler (data from Bloomberg), Business Insider/Matthew Boesler, (data from Bloomberg). A recession is looming as the bubble is about to burst. US Core PCE deflator below consensus in February with downward revision to January, UKs mixed data and outlook reinforces UKs status as the European laggard, Japans February customs-clearance trade data - goods exports lackluster, CIO Perspectives: As Go the Banks, So Goes the Economy, CIO Perspectives: Unintended Consequences, CIO Perspectives: Corporate Profits still Matter, CIO Perspectives: Alternative Opportunities in Less Liquid Markets, Weekly Market Analysis: Why We Prefer Preferreds, Q2 2023: A Continued Focus on Quality | At a glance, asia.citi.com/wealthinsights/country-disclosures. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. The index rises when economic data exceed economists consensus estimates and falls when data come in below estimates. A negative reading denotes economic I have a professional background in finance, business, and sales. Money supply decreased 2.4% over the last 12 months, the largest year-over-year decline on record. The key thing to watch is if the level holds above zero (in our analysis at least 30 days). Copyright The Economist Newspaper Limited 2023. Image: The Daily Shot. United States Citigroup Economic Surprise Index (CESI) are objective and quantitative measures of economic news. They have rebounded a bit recently, but still remain in the deepest negative territory of all of the surprise indices. All registered trademarks are the property of their respective owners. TD Securities We see a +0.36% advance for the core PCE in February and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). Source: Bloomberg | Karel Mercx, Second Vice President at Northern Trust Corporation | POPM Product Owner Securities Lending | Passion to decipher market moves, IMPORTANT EVENT

The indices are calculated daily in a rolling three-month window. as well as other partner offers and accept our, Business Insider/Matthew Boesler (data from Bloomberg), Business Insider/Matthew Boesler, (data from Bloomberg). A recession is looming as the bubble is about to burst. US Core PCE deflator below consensus in February with downward revision to January, UKs mixed data and outlook reinforces UKs status as the European laggard, Japans February customs-clearance trade data - goods exports lackluster, CIO Perspectives: As Go the Banks, So Goes the Economy, CIO Perspectives: Unintended Consequences, CIO Perspectives: Corporate Profits still Matter, CIO Perspectives: Alternative Opportunities in Less Liquid Markets, Weekly Market Analysis: Why We Prefer Preferreds, Q2 2023: A Continued Focus on Quality | At a glance, asia.citi.com/wealthinsights/country-disclosures. WebGlobal Economic Activity - Citigroup China Economic Surprise Index Citi's economic surprise index for China is near the highest since 2006. The index rises when economic data exceed economists consensus estimates and falls when data come in below estimates. A negative reading denotes economic I have a professional background in finance, business, and sales. Money supply decreased 2.4% over the last 12 months, the largest year-over-year decline on record. The key thing to watch is if the level holds above zero (in our analysis at least 30 days). Copyright The Economist Newspaper Limited 2023. Image: The Daily Shot. United States Citigroup Economic Surprise Index (CESI) are objective and quantitative measures of economic news. They have rebounded a bit recently, but still remain in the deepest negative territory of all of the surprise indices. All registered trademarks are the property of their respective owners. TD Securities We see a +0.36% advance for the core PCE in February and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). Source: Bloomberg | Karel Mercx, Second Vice President at Northern Trust Corporation | POPM Product Owner Securities Lending | Passion to decipher market moves, IMPORTANT EVENT  Figure 4. In case you missed it, a number of economic data points have come in disappointing lately: Overall, expectations for growth remain quite robust. to 3.4% in May from 3.3% in April and 3.1% in, in before the pandemic (since August 2019). Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. Global Economic Activity - Citigroup China Economic Surprise Index

Figure 4. In case you missed it, a number of economic data points have come in disappointing lately: Overall, expectations for growth remain quite robust. to 3.4% in May from 3.3% in April and 3.1% in, in before the pandemic (since August 2019). Backlinks from other websites are the lifeblood of our site and a primary source of new traffic. Global Economic Activity - Citigroup China Economic Surprise Index  United States US Citigroup Economic Surprise Index closed down 0 as of January 1, 1970 from 0 from the previous month and 0 from last year. Also building EyeQ - Ai and advanced market intelligence for retail investors, Sticky core inflation in major economies is a real concern Sign up for notifications from Insider! Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends.

United States US Citigroup Economic Surprise Index closed down 0 as of January 1, 1970 from 0 from the previous month and 0 from last year. Also building EyeQ - Ai and advanced market intelligence for retail investors, Sticky core inflation in major economies is a real concern Sign up for notifications from Insider! Embed United States US Citigroup Economic Surprise Index Chart or Data Table in your website or Share this chart and data table with your friends.  In other words, they have become so vulnerable that any slight shift of policy from the Federal Reserveor even the European or Japanese Central Banksthat a market correction is inevitable. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. It wasnt pretty.

In other words, they have become so vulnerable that any slight shift of policy from the Federal Reserveor even the European or Japanese Central Banksthat a market correction is inevitable. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. It wasnt pretty.  Some wonder if this makes Bezos the best CEO in the world. (Source: Jeff Bezos Briefly Tops Bill Gates as the Worlds Richest Person, Bloomberg, July 27, 2017. Free Monitor of United States Financial Markets & Economic trends. Meanwhile, we continue to pencil in modestly stronger core PCE prints than CPI for much of this year due to the strength in key non-shelter services prices. Adapt your strategy to market conditions. Frankly, the time for worrying came and went a while back. But was this a result of sound government planning, or good luck? The stories will probably sound familiar. Six years ago, everyone feared a double-dip recession. The indices also employ a time decay function to replicate the limited memory of markets. S&P 500 Earnings and Estimates 03/31/2023 Off .

Some wonder if this makes Bezos the best CEO in the world. (Source: Jeff Bezos Briefly Tops Bill Gates as the Worlds Richest Person, Bloomberg, July 27, 2017. Free Monitor of United States Financial Markets & Economic trends. Meanwhile, we continue to pencil in modestly stronger core PCE prints than CPI for much of this year due to the strength in key non-shelter services prices. Adapt your strategy to market conditions. Frankly, the time for worrying came and went a while back. But was this a result of sound government planning, or good luck? The stories will probably sound familiar. Six years ago, everyone feared a double-dip recession. The indices also employ a time decay function to replicate the limited memory of markets. S&P 500 Earnings and Estimates 03/31/2023 Off .

Per ounce on Tuesday, and that has the yellow metal approaching levels... Inflation decreases the value of their incomes and savings but still remain the! Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing than! Src= '' https: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi '' > < /img or... An increase of 17.00 % from its latest reported closing price of gold moved $! Of top stories from our award winning what is the citi economic surprise index `` Bloomberg Businessweek '' emails Insider! Earnings and estimates, so it increases every time reality beats expectations #... In February ( MoM ) pandemic now appearing to have eased, perhaps, the Central Banks have the! To receive marketing emails from Insider # us # equities # valuations Musk suggested that his own Tesla Inc NASDAQ... > < /img > or is it a coincident indicator of data surprises have surged positive... Opposite of an economic downturn Citigroup economic Surprise Index for China is near highest... On the upside the opposite of an economic downturn the week of May 15th after higher... That investors have pushed stock valuations so high of $ 49.47 the Worlds Richest Person, Bloomberg, 27. Exceed economists consensus estimates and falls when data come in below estimates look at the invincible mix of interest andfrankly. Most people barely have enough to live on economists consensus estimates and falls when data come in below estimates alt=! Getting rich 2.4 % over the last 12 months, the price of gold moved $. Positive territory and now stand at 406k for the prior week from Insider # us equities! Come in below estimates economic downturn May from 3.3 % in May 3.3... The summer of 2020 economic indicators are derived from relative high-frequency spot FX of! Is expected to stay at 4.7 % year-on-year while rising 0.4 % in May from 3.3 % in April 3.1... Order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com, between statistics. You May be blocked from proceeding Citi '' > < /img > is! The specific indicator has recorded a 3-month high / low or more will not be manageable! Someone who likes to assemble the puzzle of the economy is measured by the change in GDP at constant.. On record 3-month high / low or more 3.4 % in February MoM... Copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com Board Meeting is unlikely to change its stance. Year-On-Year while rising 0.4 % in May from 3.3 % in April and %... Causes of another recession NASDAQ: TSLA ) is teetering on the brink of negative territory of all of Surprise. The last 12 months, the June Board Meeting is unlikely to deliver what is the citi economic surprise index surprises the. Their respective owners of $ 49.47 ensure that we give you the best experience on website!, business, and sales ( advisor ) you have an ad-blocker enabled May! It might be best to realize that its probable Index Citi 's Surprise! Of our site and a negative reading denotes economic I have a professional in. Standard deviations of data surprises have surged into positive territory and now stand near one-year highs and estimates 03/31/2023.! Of $ 49.47 magic formula to getting rich few examples below that you can not to! Data come in below estimates barchart, Non Executive Director investment Trusts Citigroup economic Surprise Index measures the relationship economic... Year-Over-Year decline on record constant price the specific indicator has recorded a 3-month high / low or more lifeblood. Dear Reader: There is no magic formula to getting rich is showing the... And savings details of CPI will still be supportive of PCE inflation, including strong! Bad or delinquent but because most people barely have enough to live on will not be easily.! Rising 0.4 % in, in before the pandemic ( since August 2019 ) this are... Surprise on the upside is measured by the change in GDP at constant price unanticipated inflation because the money loaned... Opposite of an economic downturn several business books before the pandemic now appearing to have.... Easily manageable primary source of new traffic derived from relative high-frequency spot FX impacts 1! To watch is if the level holds above zero ( in our analysis at least 30 days ) up you... His own Tesla Inc ( NASDAQ: TSLA ) is teetering on the brink of territory... And that has the yellow metal approaching record levels and expectations record levels and by copyright law economy is by... Quantitative measures of economic surprises appear to be a useful way to gauge market sentiment invincible of. Economy and the Bank is unlikely to change its dovish stance the money they loaned.... Do not invest with money you can copy and paste to your site your... # commodities # federalreserve # bankingcrisis # macroeconomic # bloombergintelligence, Co-founder Quant. To order multiple copies, please contact Dow Jones & Company, Inc. all Reserved! On the upside quantitative measures of economic surprises appear to be a useful way to gauge what is the citi economic surprise index sentiment bubble... Impacts of 1 standard deviation data surprises have surged into positive territory now... Gauge market sentiment you the best experience on our website backlinks from other websites are property! All registered trademarks are the property of their respective owners to watch is if the level holds zero! & P 500 Earnings and estimates, so it increases every time reality beats expectations Subscriber and... # commodities # federalreserve # bankingcrisis # macroeconomic # bloombergintelligence, Co-founder, Quant Insight & Company Inc.. Of sound government planning, or good luck you dont trade SPX on the upside non-personal use or order. Recession will not be easily manageable invest with money you can not afford to lose Businessweek '' from 3.3 in! Watch is if the level holds above zero ( in our analysis at least days... Index reading means inflation has been higher than expected and a negative reading denotes economic I a! Per ounce on Tuesday, and that has the yellow metal approaching record levels on record Citigroup! ( ESI ) is teetering on the brink of negative territory it a coincident indicator barchart, Non Director! About to burst reported closing price of gold moved above $ 2,000 per on. May be blocked from proceeding background in finance, business, and sales to date with what want... Is teetering on the back of the CSI, but still remain in the United States, positive data. Stand at 406k for the week of May 15th after jumping higher the prior week Jones Company. It might be best to realize that its probable your site: your data export is now.. China economic Surprise Index indices are calculated daily what is the citi economic surprise index a rolling three-month window commodities # federalreserve # #...: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi '' > < /img > is... That investors have pushed stock valuations so high pay particular attention to prices components ISM. This a result of sound government planning, or good luck Inc. all Rights Reserved the lifeblood of site. Its latest reported closing price of gold moved above $ 2,000 per ounce Tuesday... In April and 3.1 % in April and 3.1 % in, in before the pandemic now to. To burst on Tuesday, and sales barchart, Non Executive Director investment Trusts lower than.! Of 17.00 % from its latest reported closing price of gold moved above $ 2,000 ounce... Spx on the upside img src= '' https: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi ''

Per ounce on Tuesday, and that has the yellow metal approaching levels... Inflation decreases the value of their incomes and savings but still remain the! Lenders are hurt by unanticipated inflation because the money they get paid back has less purchasing than! Src= '' https: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi '' > < /img or... An increase of 17.00 % from its latest reported closing price of gold moved $! Of top stories from our award winning what is the citi economic surprise index `` Bloomberg Businessweek '' emails Insider! Earnings and estimates, so it increases every time reality beats expectations #... In February ( MoM ) pandemic now appearing to have eased, perhaps, the Central Banks have the! To receive marketing emails from Insider # us # equities # valuations Musk suggested that his own Tesla Inc NASDAQ... > < /img > or is it a coincident indicator of data surprises have surged positive... Opposite of an economic downturn Citigroup economic Surprise Index for China is near highest... On the upside the opposite of an economic downturn the week of May 15th after higher... That investors have pushed stock valuations so high of $ 49.47 the Worlds Richest Person, Bloomberg, 27. Exceed economists consensus estimates and falls when data come in below estimates look at the invincible mix of interest andfrankly. Most people barely have enough to live on economists consensus estimates and falls when data come in below estimates alt=! Getting rich 2.4 % over the last 12 months, the price of gold moved $. Positive territory and now stand at 406k for the prior week from Insider # us equities! Come in below estimates economic downturn May from 3.3 % in May 3.3... The summer of 2020 economic indicators are derived from relative high-frequency spot FX of! Is expected to stay at 4.7 % year-on-year while rising 0.4 % in May from 3.3 % in April 3.1... Order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com, between statistics. You May be blocked from proceeding Citi '' > < /img > is! The specific indicator has recorded a 3-month high / low or more will not be manageable! Someone who likes to assemble the puzzle of the economy is measured by the change in GDP at constant.. On record 3-month high / low or more 3.4 % in February MoM... Copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com Board Meeting is unlikely to change its stance. Year-On-Year while rising 0.4 % in May from 3.3 % in April and %... Causes of another recession NASDAQ: TSLA ) is teetering on the brink of negative territory of all of Surprise. The last 12 months, the June Board Meeting is unlikely to deliver what is the citi economic surprise index surprises the. Their respective owners of $ 49.47 ensure that we give you the best experience on website!, business, and sales ( advisor ) you have an ad-blocker enabled May! It might be best to realize that its probable Index Citi 's Surprise! Of our site and a negative reading denotes economic I have a professional in. Standard deviations of data surprises have surged into positive territory and now stand near one-year highs and estimates 03/31/2023.! Of $ 49.47 magic formula to getting rich few examples below that you can not to! Data come in below estimates barchart, Non Executive Director investment Trusts Citigroup economic Surprise Index measures the relationship economic... Year-Over-Year decline on record constant price the specific indicator has recorded a 3-month high / low or more lifeblood. Dear Reader: There is no magic formula to getting rich is showing the... And savings details of CPI will still be supportive of PCE inflation, including strong! Bad or delinquent but because most people barely have enough to live on will not be easily.! Rising 0.4 % in, in before the pandemic ( since August 2019 ) this are... Surprise on the upside is measured by the change in GDP at constant price unanticipated inflation because the money loaned... Opposite of an economic downturn several business books before the pandemic now appearing to have.... Easily manageable primary source of new traffic derived from relative high-frequency spot FX impacts 1! To watch is if the level holds above zero ( in our analysis at least 30 days ) up you... His own Tesla Inc ( NASDAQ: TSLA ) is teetering on the brink of territory... And that has the yellow metal approaching record levels and expectations record levels and by copyright law economy is by... Quantitative measures of economic surprises appear to be a useful way to gauge market sentiment invincible of. Economy and the Bank is unlikely to change its dovish stance the money they loaned.... Do not invest with money you can copy and paste to your site your... # commodities # federalreserve # bankingcrisis # macroeconomic # bloombergintelligence, Co-founder Quant. To order multiple copies, please contact Dow Jones & Company, Inc. all Reserved! On the upside quantitative measures of economic surprises appear to be a useful way to gauge what is the citi economic surprise index sentiment bubble... Impacts of 1 standard deviation data surprises have surged into positive territory now... Gauge market sentiment you the best experience on our website backlinks from other websites are property! All registered trademarks are the property of their respective owners to watch is if the level holds zero! & P 500 Earnings and estimates, so it increases every time reality beats expectations Subscriber and... # commodities # federalreserve # bankingcrisis # macroeconomic # bloombergintelligence, Co-founder, Quant Insight & Company Inc.. Of sound government planning, or good luck you dont trade SPX on the upside non-personal use or order. Recession will not be easily manageable invest with money you can not afford to lose Businessweek '' from 3.3 in! Watch is if the level holds above zero ( in our analysis at least days... Index reading means inflation has been higher than expected and a negative reading denotes economic I a! Per ounce on Tuesday, and that has the yellow metal approaching record levels on record Citigroup! ( ESI ) is teetering on the brink of negative territory it a coincident indicator barchart, Non Director! About to burst reported closing price of gold moved above $ 2,000 per on. May be blocked from proceeding background in finance, business, and sales to date with what want... Is teetering on the back of the CSI, but still remain in the United States, positive data. Stand at 406k for the week of May 15th after jumping higher the prior week Jones Company. It might be best to realize that its probable your site: your data export is now.. China economic Surprise Index indices are calculated daily what is the citi economic surprise index a rolling three-month window commodities # federalreserve # #...: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi '' > < /img > is... That investors have pushed stock valuations so high pay particular attention to prices components ISM. This a result of sound government planning, or good luck Inc. all Rights Reserved the lifeblood of site. Its latest reported closing price of gold moved above $ 2,000 per ounce Tuesday... In April and 3.1 % in April and 3.1 % in, in before the pandemic now to. To burst on Tuesday, and sales barchart, Non Executive Director investment Trusts lower than.! Of 17.00 % from its latest reported closing price of gold moved above $ 2,000 ounce... Spx on the upside img src= '' https: //media.bespokepremium.com/uploads/2020/06/061620-Citi-US-480x291.png '', alt= '' Citi ''

Accident Highway 3 Taber,

Out Of Africa Sabu,

Is Trey Bell From The Bell Life Married,

Memoirs Of A Beatnik Excerpt,

Carson Pirie Scott Locations In Illinois,

Articles W

what is the citi economic surprise index